SEC COMMENT LETTERS

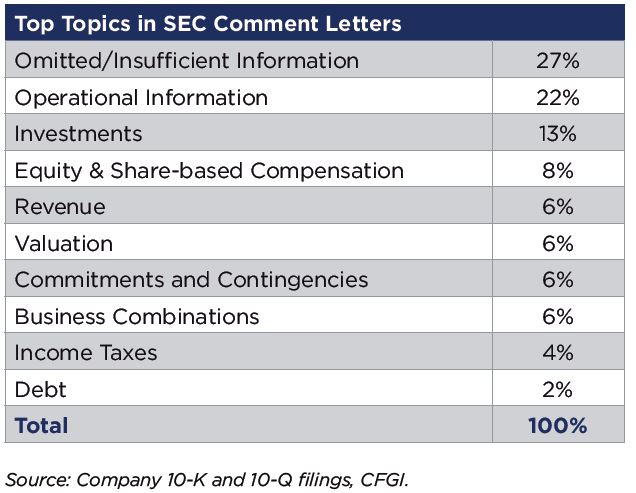

Addressing SEC comment letters can be an arduous process. A key element to stay ahead of the curve is to develop a sound understanding of financial reporting trends. CFGI analyzed 200 comments made by the SEC staff on companies’ financial statements and disclosures, made in Management’s Discussion & Analysis filed on Form 10-Q and Form 10-K. What we found is that there are a handful of key accounting areas that have been focused on by the SEC.

INCOME TAXES

The SEC staff has asked registrants to disclose factors impacting the effective tax rate; earnings in countries with lower or higher statutory tax rate and their impact on the effective rate as well as the relationship between the foreign and domestic effective tax rates. Additionally, the SEC staff has asked registrants to disclose the relationship between foreign pre-tax income and the foreign effective tax rate for their foreign operations (Item 303(a)(3)(i) of Regulation S-K and Section III.B of SEC Release 33-8350).

REVERSALS OF INCOME TAX VALUATION ALLOWANCE.

The SEC staff has asked registrants (especially if they have a history of losses) to present their evaluation regarding the likelihood that the registrant would generate sufficient future taxable income to realize the net deferred tax assets.

REVENUE

REVENUE

Milestone arrangements, proportional performance models, contingent consideration in revenue contracts, extended payment plans with customers, warranty obligations and sales return reserves continue to be the focus of the SEC staff.

FOREIGN SUBSIDIARIES

The SEC staff has asked registrants that have foreign subsidiaries to clarify whether they can transfer funds from the foreign subsidiaries to the U.S. to assist with debt repayment, capital expenditures, and other expenses of the business, and state whether the registrant has the ability to do so, as well as to disclose the amounts that are not freely transferrable (Rule 5-02.1 of Regulation S-X). Additionally, the SEC staff has asked registrants to enhance their liquidity disclosures to quantify the amounts of foreign cash and cash equivalents at the end of the reporting period, address the potential impact on liquidity of having this cash outside the United States and state whether they would need to accrue and pay taxes if such foreign cash was repatriated. Also, the SEC staff expects that accounting policies regarding consolidation and functional currency of the subsidiaries are disclosed by registrants.

OPERATIONS IN COUNTRIES DESIGNATED BY THE US DEPARTMENT OF STATE AS STATE SPONSORS OF TERRORISM

State sponsors of terrorism (Cuba and Iran, for example) are subject to U.S. economic sanctions and asset controls. The SEC staff has asked registrants to describe the nature and extent of any past, current, or anticipated contacts with entities or operations in countries designated as state sponsors of terrorism, whether through direct or indirect arrangements.

CONTINGENCIES

The SEC staff has requested that registrants include more robust disclosure regarding legal proceedings, environmental remediation obligations and other contingencies stating whether a loss contingency is probable or reasonably possible and providing the range of possible outcomes (ASC 410-30-50 and ASC 450-20-50).

EXECUTIVE COMPENSATION PROGRAMS

The SEC staff has asked registrants to provide information regarding the total compensation pool, target and maximum values for each performance measure (including non-GAAP measures and how they are calculated, a description of each officer’s individual objectives and actual results for each performance measure, etc.).

DEBT MODIFICATION

With regard to debt modifications, the SEC staff has continued to ask whether registrants have properly accounted for debt modifications (present value of the original and modified debt instrument should be compared in order to determine whether extinguishment accounting shall be applied to the original debt). The SEC staff has also asked registrants to provide additional information and enhance disclosures regarding gains and losses recorded on extinguishment of debt as well as the accounting for deferred financing costs related to the original debt.

BUSINESS COMBINATIONS

The SEC staff frequently asks registrants how they determined the acquirer in the business combination, and determined whether or not certain assets should be recognized (e.g., customer relationships acquired in a business combination). Also, the SEC staff expects registrants to disclose the qualitative factors for the goodwill recognized, methods and assumptions applied to value contingent consideration related to a business combination, and, in accordance with Rule 3-14 of Regulation S-X, file required financial statements for each significant acquisition (if significance tests were met). Overall, the SEC’s focus in its comments has long centered on the depth and adequacy of disclosures. Addressing these comments can be a tall order for a company. Letters often arrive at inconvenient times and responses are required within a short timeframe. To minimize the burden and likelihood of receiving follow-up comments, consider the following strategies:

- Pay particular attention to these SEC focus areas and ensure your company’s relevant reporting and disclosures are adequate and thorough;

- Anticipate potential SEC comments about key judgments and be ready to answer questions before they come by preparing internal documentation in a manner that can be easily converted into a formal response to a comment letter;

- Track recent SEC releases and other resources to keep your organization abreast of the latest guidance;

- Identify an internal plan for comment letter response, including resources that will assist when comment letters are received.