In August 2016, the FASB issued ASU 2016-15, Clarification on Classification of Certain Cash Receipts and Cash Payments on the Statement of Cash Flows, to create consistency in the classification of eight specific cash flow items. Though this standard is effective for calendar-year SEC registrants beginning in 2018, companies should begin evaluating the accounting for these transactions under this guidance in order to establish presentation consistency for when the guidance becomes mandatory and consider whether early adoption is appropriate.

WHAT TO EXPECT?

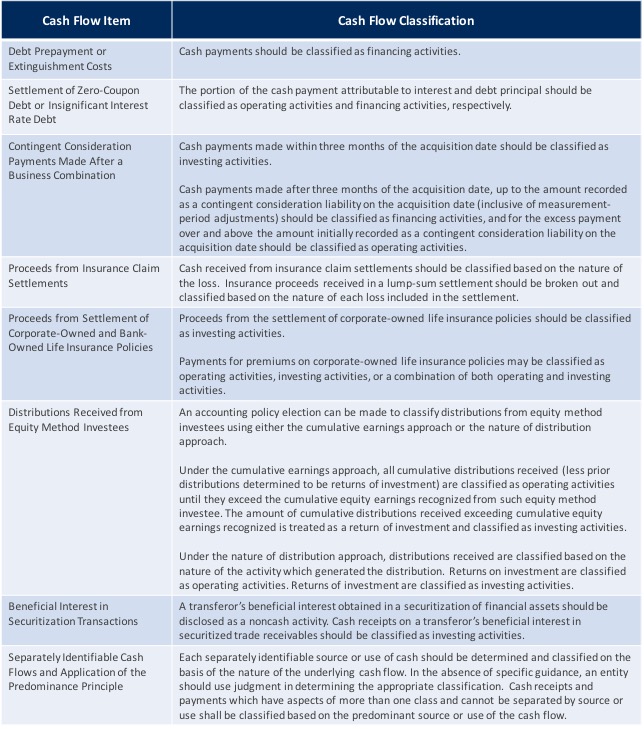

The new guidance was issued to address the diversity in practice in how certain cash receipts and payments were presented and classified on the statement of cash flows. Prior to this release, GAAP was either unclear or did not provide specific guidance on how these issues should be presented in the statement of cash flows. The amendments issued with this guidance are summarized in the table below:

In addition, in its October 2016 meeting, the FASB is expected to discuss the issuance of a related ASU to address a ninth specific cash flow item: the classification of restricted cash in the statement of cash flows.

Transition Timeline

NEXT STEPS AND HOW CFGI CAN HELP

We encourage companies to evaluate the impact of this ASU on their financial reporting. As current guidance under US GAAP does not specifically address the cash flows addressed in ASU 2016-15, entities should consider whether early adoption is appropriate. CFGI can assist clients with performing assessments, understanding information needs, updating documentation, communicating potential changes to management and auditors, and helping direct the transition plan.