The umbrella partnership C corporation (Up-C) structure has been a popular option for pass-through entities looking to gain access to the capital markets. The structure enables pass-through entities, such as partnerships and limited liability companies, to retain preferential tax treatment for pre-IPO investors as well as the newly created public company. At the same time, access to capital markets enables the business to aggressively pursue its growth objectives.

What is an Up-C structure?

The Up-C structure gets its name from the Up-REIT structure, which became popular in the 1990s. That structure allows property owners to exchange their property for shares in the Up-REIT, generally on a tax-free basis. In doing so they gain an interest in a diversified real estate portfolio and the ability to create liquidity. The Up-C structure inherits similar benefits.

Companies structured as a partnership often take the traditional route to IPO by converting to a corporate entity which will be used to raise capital in the public markets through a share offering. The Up-C structure takes a modified path, whereby a C corporation is still created that will raise capital in the public market. However, the C corporation invests the raised capital into the partnership where the business operations remain. The owners of the partnership continue to own their interest in the operating partnership together with the public C corporation as partners. This enables the owners of the partnership to continue to have flow-through treatment and thus a single layer of tax on income earned and distributed to them. In addition, income that is earned and not distributed will increase their tax basis in the partnership, which reduces the gain on their ultimate disposition of their ownership interest.

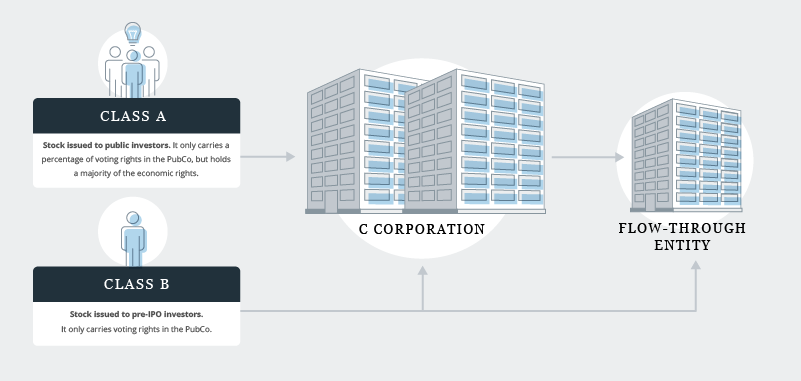

Essentially, the C corporation, or PubCo, is organized as a holding company with a single subsidiary, the original partnership or LLC. The capital structure of the flow-through entity becomes modified: The interests of the original owners are transformed into a new class exchangeable for the PubCo’s common stock. During the IPO, the PubCo issues two classes of common stock:

- Class A: Stock issued to public investors. It only carries a percentage of voting rights in the PubCo, but holds a majority of the economic rights.

- Class B: Stock issued to pre-IPO investors. It only carries voting rights in the PubCo.

The Up-C structure has been highly favored by companies backed by private equity or venture capital because those types of investors tend to use flow-through entities to maintain interests in portfolio companies. In addition, legacy partners within this structure have the right to exchange their interests for PubCo stock, which they can then monetize. Alternatively, the PubCo may retain the right to obtain legacy partner interests through cash transactions.

The following diagram illustrates the most common arrangement of an Up-C structure:

What to consider before leveraging the Up-C structure

Generally, a company can expect to gain the most value from an Up-C structure if it operates as a flow-through entity for tax purposes and expects to generate taxable income in the future. Before pursuing this path, companies should consider the reporting implications that will affect the PubCo. The original owners should scrutinize the best way to present their retained non-controlling shares of the flow-through entity.

In addition, most Up-C structures receive tax savings through a tax receivable agreement (TRA). The TRA requires the PubCo to pay the original owners a percentage of incremental cash-tax savings. These savings are applied to tax attributes delivered to the PubCo during the IPO process. These attributes include a tax-basis step-up achieved by the PubCo’s purchase of interest in the flow-through entity. Therefore, the PubCo will need to determine how to present the TRA in its financial statements.

What are the benefits of an Up-C structure?

The Up-C structure can be a highly flexible strategy for creating value through an IPO. The most noticeable benefit of the arrangement is the lack of corporate taxes for the original owners. While these taxes still apply to the PubCo, the original flow-through entity retains its preferential status. Pre-IPO investors also gain benefits such as:

- The ability to receive proceeds from the TRA.

- The right to exchange their interests in the flow-through entity for PubCo stock.

- The capacity to avoid double taxation.

- The power to control the company through a majority percentage of PubCo voting shares.

Usually, most of the tax savings generated by the Up-C structure go to the original owners. However, the PubCo may also pay a percentage of the savings to existing shareholders as dividends — or opt to reinvest those savings in the company.

What are the reporting implications of an Up-C structure?

Business owners should always consider the reporting implications of the Up-C structure before taking this path. A knowledgeable capital markets advisory partner can help owners to determine if this option is the right way to proceed.

At a basic level, owners should consider the following for SEC Reporting purposes:

- Tax implications: After the IPO, the PubCo recognizes income tax expenses and benefits for the flow-through entity.

- Presentation of non-controlling interests: The PubCo usually presents the original owner’s retained equity in the flow-through entity as non-controlling interests, but this may not always be the case. A tax specialist should inspect these interests for cash redemption features, which may or may not be at the option of the PubCo.

- Presentation of the TRA: Generally, the TRA is presented as a liability because it requires the PubCo to distribute cash to the original owners. This and other liabilities may evolve as owners monetize their shares.

- Article 11 pro forma financial information: In some cases, the SEC may require the PubCo to create pro forma financial information of the newly created registrant for the IPO and future filings.

If you are interested in learning more about the Up-C structure and how CFGI can help you take this alternative route to an IPO, please contact April Coleman, Partner (603-686-2020, acoleman@cfgi.com).