As economic challenges continue, immediate efforts to preserve cash flow and working capital will lead finance leaders to focus on longer-term operational efficiency and cost optimization gains to maintain a stable footing.

Finance leaders are uniquely positioned to drive cost optimization given the nature of finance work and the insight their teams have into other corners of the enterprise. By leading the way, CFOs can dictate their cost optimization strategies and set the tone for more expansive efforts that impact the entire organization.

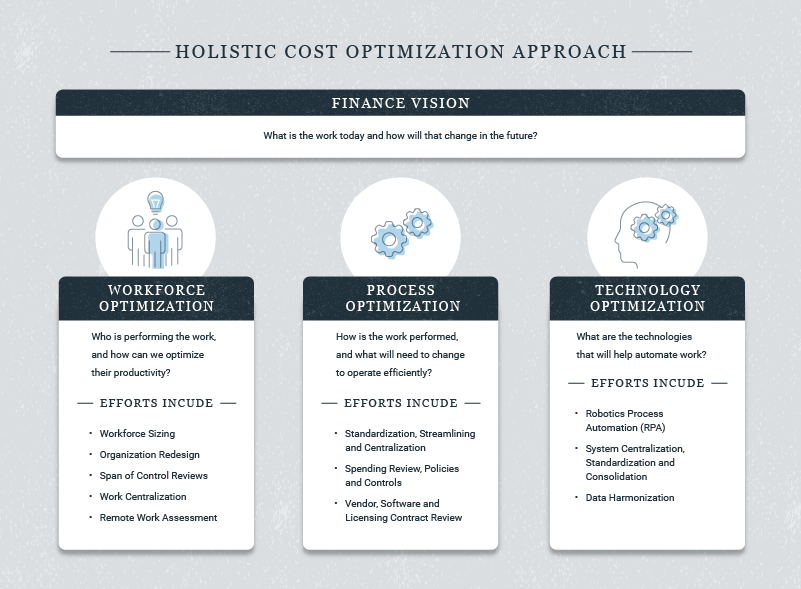

To get the best results, CFOs should take a holistic approach to cost optimization, first deciding what work needs to be optimized, and then assessing which people, process and technology optimization levers to pull.

Prioritize cost optimization efforts around transactional work

Opportunities to reduce costs exist in every organization, but it can be difficult to know where to begin your efforts. In CFGI’s experience, we often find that transactional, rules-based work is the best place to start. Accounts payable, accounts receivable, journal entries and other transactional tasks are often burdened with inefficiencies and manual processes. Cost optimization efforts can address those issues, helping finance organizations run cheaper, better and faster while scoring some quick wins.

Every organization has different needs and competencies. Some will already have a need to optimize processes while others will need to look at modernizing the technology stack. By starting with the question of what work should be optimized, finance leaders can get a better sense of what needs to be done and where to focus their efforts.

Ask yourself:

- What work do I do today?

- What work should I prioritize for my cost optimization efforts?

- What levers can I pull to optimize costs?

Redesign, standardize and streamline your processes

Process optimization presents significant opportunities for many organizations. Numerous disparate processes owned by different stakeholders are costly to maintain, difficult to manage, and present control risks. By streamlining and standardizing processes, organizations stand to reduce costs, minimize potential for control deficiencies, all while laying the groundwork for further cost optimization.

Common focus areas for process optimization include financial reporting, annual planning or forecasting. These workflows have an impact on tangible business goals and are often burdened with inefficiencies such as:

- Continuous data cleansing.

- Manual consolidations.

- Long close processes.

- Misaligned chart of accounts across different departments.

- Lack of standardized or real-time reporting.

- Data silos in procurement and other accounts payable tasks.

Processes requiring a significant amount of manual work or that are prone to error present additional opportunities. Assessing and optimizing these tasks can deliver immediate cost-savings and productivity gains.

What does an optimal process look like? In our experience, ideal-state processes share these characteristics:

- Scalable: Allows businesses to expand as needed aligned to business growth. At the same time, staffing requirements increase at a linear rate or sometimes only incrementally.

- Transparent: Enables the appropriate stakeholders to accurately, thoroughly and unambiguously understand the components and moving parts of the operating model.

- Adaptable: Rapidly responds to shifts and changes in the business and technical environment.

- High-performing: Produces clear customer value while efficiently using resources to minimize costs.

- Extensible: Allows for new business functionality to be quickly and seamlessly incorporated into the existing environment.

- Robust: Provides stability so the organization can take advantage of new opportunities and respond to changes in the business environment.

While organizations may want to tackle different elements of the equation first, standardized and streamlined processes make it much easier to address the people and technology components.

Ask yourself:

- What processes do I have today, and what is my level of standardization?

- What pain points am I encountering that prevent my organization from operating efficiently and effectively?

- What are my ideal state processes?

- Where can I begin my process optimization efforts?

Repurpose your workforce

The next logical step in the cost optimization journey is to consider who is doing the work and how the current organization supports and promotes productivity. Finance leaders may find that their organizations are not properly structured to fully support an efficient, high-performing team.

Having gone through process standardization, finance leaders should be in a better position to assess how much time and manpower is needed for the organization to run at an optimal level and meet that ideal future state. In some cases, this may involve identifying areas where people may need to be reassigned or redeployed to maximize resources and operational efficiencies.

Common inefficiencies also result from misalignment between the CFOs organizational structure and the enterprise. CFOs should assess their organizational structure to ensure it properly supports the needs of the business. There is no size fits all in this regard, but we recommend following these steps to get started with workforce optimization:

- Review your organizational structure and determine if it’s aligned with your business strategy.

- Analyze the size and shape of your workforce to ensure employees are focusing their time on value-add work.

- Build learning programs in your organization in order to increase employee retention and save on recruiting costs.

- Assess remote work capabilities, real estate assets and lease obligations.

- Develop an organizational culture that prizes efficiency and continuous improvement.

Unlike process optimization, finance leaders should not approach their workforce solely with efficiency gains in mind as personnel decisions can have a huge impact. Addressing workforce optimization requires a greater sense of empathy and understanding, while also aligning your efforts with an overarching business strategy.

Ask yourself:

- Is my organization structure aligned to my business strategy?

- What do my employees do today? Where should I focus my employees’ time?

- Where is work being done? Do I have the right mix of physical and remote work?

- Am I building a culture that allows employees to do their best work?

Explore automation and discover your quick wins

There are many different ways to leverage technology to drive cost optimization and numerous potential solutions to consider. However, we have found that a focus on technology enablement – Robotic Process Automation (RPA), in particular – is often a great starting point because it can deliver immediate cost-saving, in rapid fashion, typically deploying within 8 – 10 weeks from kickoff.

According to Gartner, the average accounting department spends 30% of its time addressing rework tasks that could otherwise be automated through RPA. For an organization with 40 full-time members on its accounting staff, that translates into roughly 25,000 hours saved each year. In dollar figures, a company of that size could save up to $800,000 every year with RPA.

Beyond pure cost-cutting measures, RPA replaces mundane and repetitive tasks that employees are forced to handle as part of their jobs. In many cases, those tasks offer very little strategic business value. By assigning those jobs to RPA solutions, team members can focus on more value-driven work that directly impacts the bottom line.

The best candidates for automation include tasks that are:

- High-volume.

- Rules-based.

- Structured.

A number of different processes fit those guidelines, including those requiring:

- Data entry, migration and harmonization.

- Tedious documentation work.

- Calculation-based tasks.

- If/then process rule sets.

- Copy and paste jobs.

Finance organizations are no strangers to that kind of work. Accounts payable and accounts receivable functions feature many tasks that would fit that description, requiring both excessive data inputs and a high degree of manual interaction.

Ask yourself:

- What work is highly manual, repetitive and transactional?

- What work is taking time away from analysis due to its tedious and mundane tasks?

- What changes may be on the horizon for my business that could disrupt how work is done?

- What business outcomes do I value the most (e.g., cost savings, error reduction, 24/7 availability, etc.)?

- How can I develop an automation communication plan to inspire, not intimidate, my workforce?

Think holistically about cost optimization

As part of broader Finance Transformation trends, CFOs are increasingly faced with a dual mandate: do more with less while driving strategic direction. Both demands need to be addressed in a holistic fashion to serve the needs of the organization today and in the future. CFOs would be wise to begin with a vision for the future, and incorporate all three elements (people, process, technology) when devising a cost optimization plan.

Cost optimization can be difficult to plan and execute, but finance organizations are in a unique position to spearhead these efforts. CFOs have insight into financial processes that stretch into every corner of the enterprise, making them natural leaders for organization-wide cost optimization.

To find out more about Finance Transformation and how CFOs can lead the charge within their own organizations, download our new Finance Transformation guide.

For more information on our Cost Optimization offering, please contact Andres Garzon, Partner (agarzon@cfgi.com, 617-306-1888) and Robert Winslow, Managing Director (rwinslow@cfgi.com, 203-482-9764).

Acknowledgements – We’d like to thank the following contributors:

- Kathryn Streeter, Benchmarking

- Adam Cranmer, Robotic Process Automation (RPA)

- Stephanie Seitz, Process Optimization

- Ryan Sullivan, Workforce Optimization