Inevitably, companies looking to go public will face the prospect of comment letters from the Securities and Exchange Commission (SEC). Before an initial public offering (IPO) can be declared effective, the SEC must ensure that investors have sufficient information to make an informed decision. A company’s disclosures of non-GAAP measures and operating metrics are the subject of significant scrutiny and frequent comment by the SEC.

SEC comments can delay the IPO process

When evaluating a company’s registration statement, the SEC focuses on whether or not the disclosures within provide enough clarity for investors to make an informed decision. Filers can expect to receive a comment letter on their initial registration statement within a month of filing and within ten business days for subsequent amendments. Comments from the SEC may include:

- Direct requests to amend or expand disclosures.

- Inquiries regarding the accounting treatment for certain transactions.

- Inquiries regarding compliance with disclosure requirements.

- Requests for supplemental information.

A comment letter is never boilerplate, but certain themes and trends are seen in the comments routinely issued by the SEC. Companies can typically expect two or more rounds of comments on IPO registration statements. Registrants are required to respond in writing and must clear all comments in order for the SEC to declare the registration statement effective. The SEC may take up to 27 days to review an initial filing and up to 10 business days for a subsequent amendment. Companies should plan for multiple comment letters and SEC review time when preparing an IPO timeline. Companies that work with a knowledgeable IPO-readiness partner are often able to limit the number of comments they receive and achieve greater flexibility around the timing of their roadshow, pricing and completion of the offering.

Understanding SEC comment trends

While SEC comments are specific to each review, there are trends that companies should be aware of in order to mitigate the risk of delaying their IPOThe top three topics addressed in SEC comments are management’s discussion and analysis (MD&A), non-GAAP measures and revenue recognition.

Considering 31% of all reviews receive a comment related to non-GAAP measures, it is crucial to understand why they occur. With this understanding — and the support of a financial advisory partner — companies can avoid these comments and keep their IPO timelines on track.

Non-GAAP measures cause pre-IPO companies to stumble

Non-GAAP measures, in SEC comment letters, continue to be an area of focus, particularly in IPO registrations.

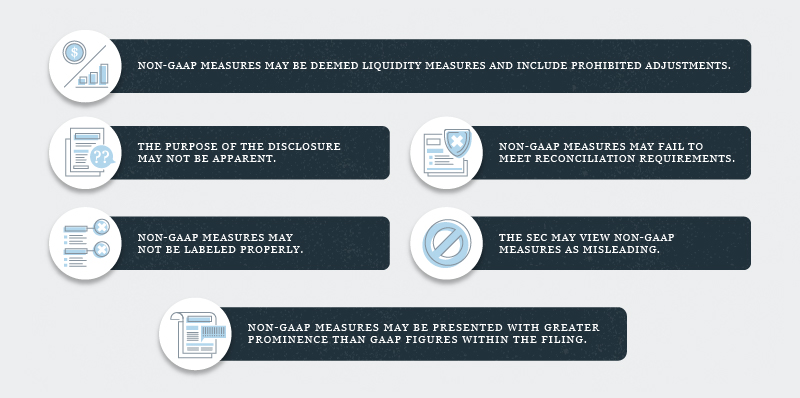

It’s important to understand that the use of non-GAAP measures serve a strategic purpose, in that they allow potential investors to view the company’s performance through the eyes of management. However, in order to ensure consistency and keep non-GAAP measures from being misleading, the SEC has put in place strict requirements that have been in the spotlight recently. There are several reasons why non-GAAP measures trigger SEC comments.

We’ve highlighted some of the most common comments here, but this list is not exhaustive:

- Prominence. The SEC dispenses comments when non-GAAP measures are more prominent than comparable GAAP measures. This can occur when non-GAAP measures appear before GAAP measures or if there is a higher volume of non-GAAP measures compared to GAAP measures. The tone in which the registrant emphasizes certain measures may also trigger comments.

- Clear labeling. If registrants use titles for their non-GAAP measures that are confusing or similar to GAAP measures, the SEC may object to the use of the title or ask for clarity. Providing context around the measures can help to reduce the risk of receiving comments.

- Purpose and use. Registrants should always explain why they have used non-GAAP measures. Registrants should consider why these measures are relevant to investors and disclose why non-GAAP measures are useful for telling their story.

- Liquidity measure or performance measure? It may not always be clear whether a registrant has used non-GAAP measures to assess its liquidity or its performance. There are different requirements for each and companies must provide clear disclosure as to why the non-GAAP measure was used. Adjustments that may be permissible in calculating a performance measure may be prohibited in connection with a liquidity measure.

- Misleading adjustments. If a non-GAAP measure is deemed misleading, it will trigger a comment. For instance, non-GAAP measures can mislead investors if they individually tailor revenue recognition or other GAAP accounting. Comments received on this topic may require that the registrant modify or eliminate certain adjustments in determining the non-GAAP measure.

- Reconciliation issues. Registrants may fail to reconcile non-GAAP measures back to the appropriate GAAP measure, resulting in SEC comment. Registrants may be required to modify their reconciliation or related disclosure in response to such comments.

Work with a partner that understands the IPO process

With the right partner, companies can limit the risk of receiving SEC comments, which can significantly delay IPO timelines. At CFGI, our teams bring Big Four experience and a hands-on approach when preparing documents vital to the IPO process. Our IPO-readiness team understands how to prepare and draft the financial sections of the registration statement as well as how to create SEC comment letter responses.

CFGI has been down the road to IPO many times. To learn more about how we can help your company go public, get in touch with us today.