Over the course of the past decade, there has been much discussion about automation in the finance function. While it is true that traditional finance tasks have become increasingly automated, that’s only part of the story.

In reality, what is happening is a fundamental shift in the expectations of your workforce. With CFOs under immense pressure to deliver higher levels of performance, they need to think critically about re-skilling their workforce to meet the needs of their evolving business.

Finance leaders who are proactive in this endeavor are solidifying their seats at the decision-making table. Others who do not act may struggle to be seen as true leaders in the C-suite.

This is no small task – even with a strong understanding of where the business is headed, CFOs often lack the roadmap needed to build a team that is future-ready and proactively meets the broader business’ needs.

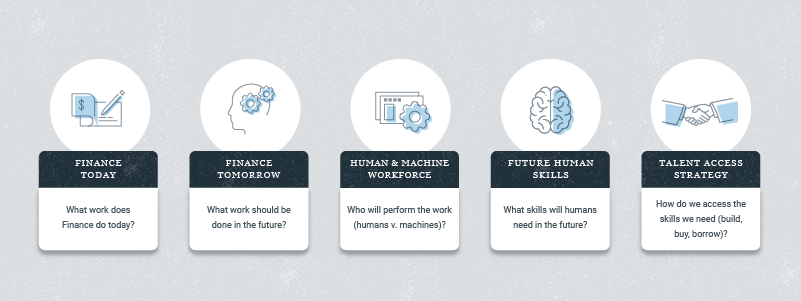

To identify the best path forward, CFOs should consider the following:

Business is changing – and that means new expectations for finance

The world in which businesses operate is rapidly changing. What was standard practice yesterday may get disrupted today and be completely replaced tomorrow. Leaders face a host of business and technology disruptors, such as changing consumer expectations, economic uncertainty, event led disruptions such as mergers and acquisitions, and evolving technologies like Robotic Process Automation (RPA).

Within this ever-changing context, companies are changing the business outcomes they prioritize in order to meet the needs of their customers and stakeholders. A similar story is unfolding for the CFO organization. Finance leaders need to think critically about how changing business expectations will require finance to work differently.

Combined, these factors have created a dual mandate for the office of the CFO:

- Cost efficiency: Pressure to perform transactional work cheaper, better and faster.

- Business partnering: Pressure to evolve into a strategic partner providing value-add services to the business

Finance leaders should think about identifying the right technology and processes to meet the first mandate. To meet the second, CFOs should think critically about how their workforce needs to evolve.

Ask yourself:

- What trends are affecting your broader business, and what outcomes will the broader business want to achieve?

- How do those business outcomes affect the expectations of finance?

- How will you evolve your workforce in order to meet these new expectations?

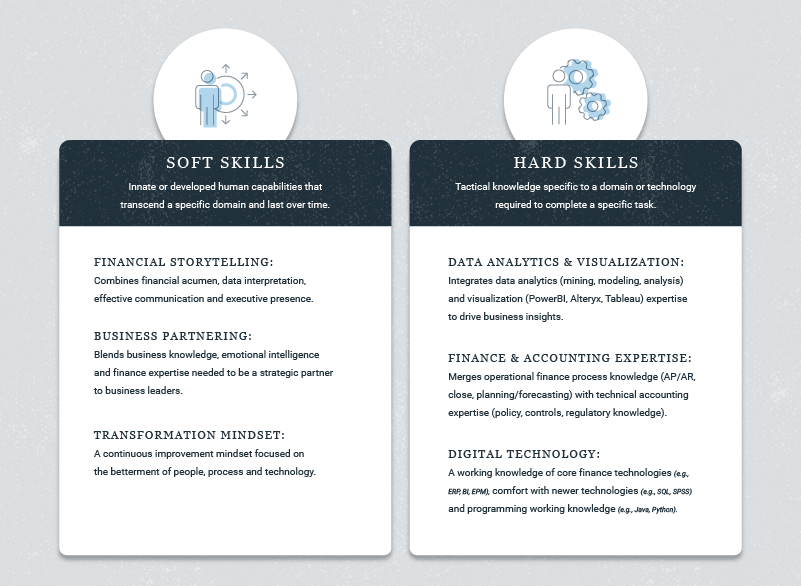

Future skills: Identify what your finance team needs

Changes to the work the CFO organization is responsible for will affect the skills needed in the future finance workforce. Traditional finance work like accounts payable and accounts receivable, as well as the data aggregation required for financial reporting are still core competencies of finance organizations. However, these tasks can be increasingly automated, requiring less time to complete. With additional capacity freed up, finance employees can focus on more cognitively demanding work such as data visualization, scenario analysis and business partnering. To stay competitive, this shift will require a rethinking of both your team’s technical and soft skills.

Here’s a simple breakdown of what we see as the key future skills for finance professionals:

We do not expect less demand for finance professionals in the future. Rather, we see a shift in the type of skills finance professionals need to have. This new type of work requires leaders to think critically about how to retool their workforce for success. Planning ahead for these changes by setting a vision for your future workforce skills is critical.

Ask yourself:

- What work will be done by machines vs. humans?

- What skills will employees need to successfully deliver on new expectations for finance?

- What soft and hard skills are most critical to our organization?

Assess your team and understand your skill gaps

With a clear understanding of the future skills needed by the finance team, leaders need to take stock of the skills possessed by their employees. CFOs can work with HR to understand where their team is today and what work needs to be done to be prepared for the future. Bringing HR into the discussion provides insight into how the team can evolve. There may already be initiatives in place to fill the gaps, but additional work may be needed to establish a firm foundation for the years to come.

Ask yourself:

- What skills does your finance team have today?

- Where are the skill gaps in your organization?

- What initiatives are already underway to fill those gaps?

Build your talent strategy: Define your plan to access the skills you need

There are three primary means of addressing skill gaps within the finance organization: You can upskill existing employees, recruit full-time talent from external sources or leverage on-demand talent (e.g., managed service providers, contractors, freelancers). In short, the question is, will you build, buy or borrow?

- “Build” (re-skill internally): Build out your current talent’s skill set when the demands for skills are not time-sensitive, the skill can be trained, and you want to build your team.

- “Buy” (hire externally): Buy the talent you need by recruiting when skills are required full-time, skills are difficult to train, and the skill is crucial to your organization’s success.

- “Borrow” (leverage on-demand talent): Borrow temporary/contingent talent when you need to quickly bridge a skills gap or the demand for the skills is seasonal.

Ask yourself:

- Build: Where should you focus your efforts on upskilling existing employees?

- Buy: Where should you prioritize attracting external talent?

- Borrow: Where should you leverage on-demand sources of talent like consultants, contractors and freelancers?

Plan now to prepare your workforce for the future

Developing the workforce of the future is a series of integrated challenges. New expectations for finance means new work, which in turn means new skills and new ways of accessing talent.

Furthermore, organizations need the right technology and processes to ensure talent can be leveraged to its maximum potential. Finally, CFOs should also consider how they will deploy their workforce in the future, whether within a traditional office or from virtual locations. Remote work may open up access to a wider talent pool.

Increasingly, finance leaders are taking a hybrid approach to solving these challenges – embracing both a virtual and physical environment that meets the organization’s needs. The increase of collaboration tools (e.g., Slack, Zoom, Microsoft Teams) and engagement methods (e.g., virtual happy hours, frequent mentoring coffee chats) are being used to help ensure a happy and productive workforce. CFOs can go the extra mile by promoting a culture of collaboration and investing in training for their workforce. The tools are there, and the leaders who take advantage of them will increasingly see a high Human Capital ROI.

CFOs will need to be proactive in their approach to defining the skills they need and creating a plan to access those skills. Finance talent is now a CFO issue, not simply an HR issue. Crafting a future workforce strategy now will give you the team you need to achieve your goals in the future.

Learn More:

To see our latest thoughts on how leading firms are building future-oriented Finance Transformation strategies, get your free copy of our Finance Transformation white paper.

Alternatively, feel free to view our Future of the Workforce webinar hosted by the Association of Chartered Accountants in the United States (ACAUS).

If you are interested in learning more about CFGI’s Finance Transformation services related to the Workforce of the Future, please contact Andres Garzon, Partner (agarzon@cfgi.com, 617-306-1888) or Robert Winslow, Managing Director (rwinslow@cfgi.com, 203-482-9764).

Acknowledgements

Key Contributors:

Ryan Sullivan, Manager, Workforce of the Future SME (rsullivan@cfgi.com, 978-270-1302).