Under the Securities Exchange Act of 1934, the SEC classifies publicly traded companies by their filing status (i.e., non-accelerated filer, accelerated filer or large accelerated filer) primarily on the basis of their public float, which is a measure of the value of their market capitalization excluding shares held by affiliates. The filing status of a company impacts the due date of its quarterly and annual filings to the SEC.

This is a road map on how to navigate the rules for determining the filing status as well as transitioning between filing statuses. Additionally, we will discuss what it means to be a smaller reporting company (“SRC”) or an emerging growth company (“EGC”).

When and How to Do the Calculation for Measuring Public Float

Calendar year filers should determine their filing status as of June 30, 2023. An issuer’s filing status is determined on the basis of its public float. Public float is calculated by multiplying the number of the company’s common shares held by non-affiliates by the current market price and, during an initial public offering (“IPO”), by multiplying the common shares covered by the registration statement by the company’s estimated public offering price. In certain scenarios, a company may have no public float because it has no publicly traded common shares outstanding or because there is no market price for its common shares.

Key Terms

- An accelerated filer is a reporting company that has a public float of between $75 million and $700 million, has been filing periodic reports for at least 12 months, has previously filed at least one annual report and is not an SRC.

- A large accelerated filer is a reporting company that has a public float of $700 million or more, as of the last business day of the issuer’s most recently completed second fiscal quarter.

- A non-accelerated filer is a reporting company that does not meet the requirements of a large accelerated or an accelerated filer. Companies going through an IPO will be considered non-accelerated filers regardless of whether they satisfy the requirements to qualify as a large accelerated filer or an accelerated filer.

- An SRC is a reporting company that is not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent that is not an SRC and that meets certain criteria described in detail below.

- An EGC is an election that a newly public company can make, which offers the company certain benefits such as the ability to adopt newly issued accounting standards with private companies and a delay in the requirements of Sarbanes Oxley, until it no longer qualifies as an EGC as described below.

Transitioning Between Filing Status

The determination at the end of the issuer’s fiscal year filing status of whether a company is a large accelerated filer, accelerated filer or a non-accelerated filer governs the deadlines for the annual and quarterly reports to be filed by issuer for the subsequent fiscal year and all annual and quarterly reports to be filed thereafter until the time in which the issuer’s filing status changes.

Once an issuer becomes an accelerated filer, it will remain an accelerated filer unless:

- The issuer determines that the aggregate market value of the common equity held by its non-affiliates was less than $60 million, as of the last business day of the issuer’s most recently completed second fiscal quarter; or

- It determines that it meets the requirements to become an SRC under the revenue test.

An issuer that determines it has become a non-accelerated filer and will not become an accelerated filer again unless it subsequently meets the conditions of this status.

Once an issuer becomes a large accelerated filer, it will remain a large accelerated filer unless:

- It determines that the aggregate market value of its common equity held by its non-affiliates was less than $560 million, as of the last business day of the issuer’s most recently completed second fiscal quarter; or

- It determines that it meets the requirements to become an SRC under the revenue test.

If the issuer’s aggregate market value was $60 million or more, but less than $560 million, as of the last business day of the issuer’s most recently completed second fiscal quarter, it is not eligible to be considered an SRC under the revenue test and it would become an accelerated filer. If the issuer’s aggregate market value was less than $60 million, as of the last business day of the issuer’s most recently completed second fiscal quarter, or it meets the requirements to be considered an SRC under the revenue test, it becomes a non-accelerated filer. An issuer will not become a large accelerated filer again unless it subsequently meets the conditions for this status.

What are the Qualifications Criteria for SRC and EGC Status?

Filing status should not be confused with EGC or SRC, which are separate designations that can provide different SEC requirements and benefits. EGC and SRC are reporting regimes a company can elect if it meets the requirements, and this is separate from the determination of an issuer’s filing status as either a non-accelerated, accelerated or a large accelerated filer.

An SRC is an entity that is not an investment company, asset-backed issuer or majority-owned subsidiary of a parent that is not an SRC, and qualifies based on the following criteria:

- Annual revenues of less than $100 million;

- and a public float which is the aggregate market value of the issuer’s outstanding common equity held by non-affiliates of less than $700 million.

An issuer can elect to be an EGC during its IPO process and remains an EGC until the first day of the fiscal year upon meeting one of the following requirements:

- The last day of the fiscal year the issuer had greater than total annual gross revenues of $1.2 billion;

- The last day of the fiscal year following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective registration statement under the Securities Act of 1933;

- The date on which such issuer has, during the previous three-year period, issued more than $1 billion in non-convertible debt; or

- The date on which an issuer is deemed to be a large accelerated filer.

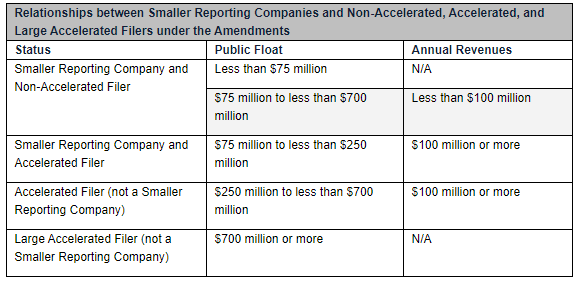

The table below shows the relationship between SRCs and non-accelerated, accelerated and larger accelerated filers:

CFGI can help companies of any size including non-accelerated, accelerated and larger accelerated filers as well as EGC and SRC companies. If you need help with this process, get in touch with us today.