The global COVID-19 crisis is impacting all aspects of society and business. In short order, it has become a very real issue for organizations to contend with.

Business executives, and Chief Financial Officers in particular, are facing a period of uncertainty and a global downturn without a clear sense of length or depth. What is clear is that there will be pressure to tightly manage working capital and spending to offset impacts in revenue. Yet naturally the question on the CFO’s mind is an important one – how will this affect my workforce?

We have learned from history that articulating a clear, cohesive plan in times of uncertainty and minimizing impacts to your workforce will allow your organization to weather the storm and emerge stronger. The directive of the CFO is clear – analyze spend and establish tight controls around the balance sheet including liquidity and liability management.

At CFGI, we have the experience to help you prioritize strategies and initiatives that will help your organization analyze and optimize spend and manage liquidity. We work as an extension of your team, with empathy, and strive to understand the unique challenges of your organization.

If the next question is – “Where do I begin?” Organizations must immediately understand their current financial picture including a holistic assessment of spend, cash flow and liabilities. CFGI can provide expertise and operational support in the following areas:

- Liquidity assessment and 13-week cash flow modeling.

- Cash and working capital management.

- Debt covenant management.

- Bank and revolver management.

- Accounts payable, accounts receivable and payroll management.

- Holistic enterprise-wide spend review and analytics.

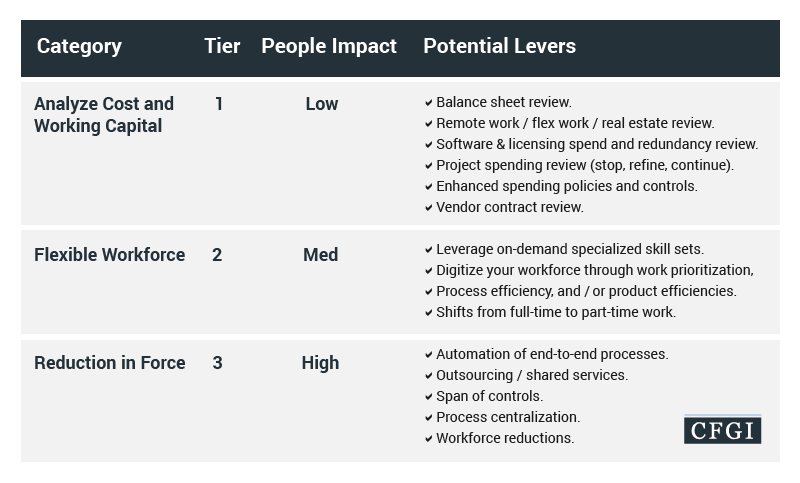

Once we have together established a firm understanding and assessment of your current financial profile, we will chart a course forward. CFGI recommends leveraging a tiered approach that starts with identifying opportunities that can be executed quickly, understanding that your people are your most important asset. Here are a few ways you can start to optimize your cost structure and balance sheet while reducing the impact to your workforce:

The time to act is now – the decisions you make today will affect your organization and your people tomorrow. During today’s challenging business environment, prioritize your workforce, and start by finding targeted cost savings opportunities today.

If you are interested in learning more about CFGI’s CFO Spending and Working Capital Contingency Plans, please contact Andres Garzon, Partner, Finance Transformation (agarzon@cfgi.com, 617.306.1888), Robert Winslow, Managing Director, Finance Transformation (rwinslow@cfgi.com, 203.482.9764) or Ryan Sullivan, Manager, Finance Transformation (rsullivan@cfgi.com, 978.270.1302).