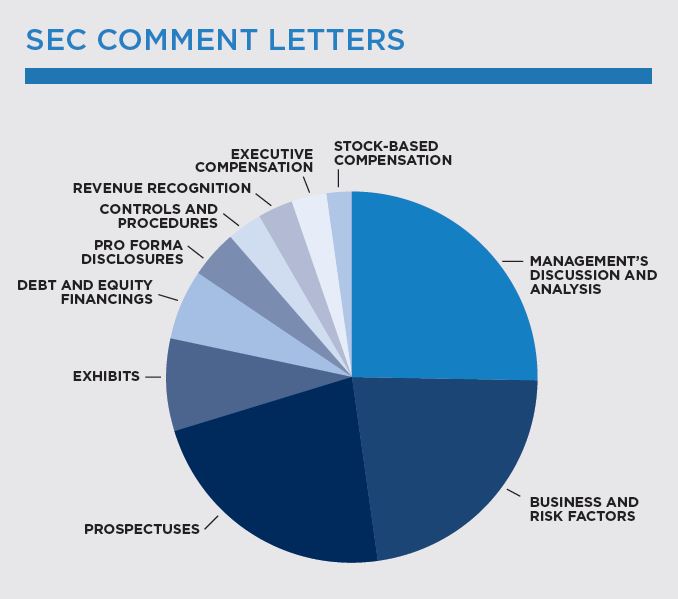

Our analysis of SEC Comment Letters is based on our research of companies with a market capitalization between $100 million and $1 billion that extends back to January 1, 2013. Our research indicates the trends in SEC Comment Letters continue to be consistent from period to period with MD&A remaining the most common topic to receive an SEC Comment Letter. The areas within MD&A that receive SEC Comment Letters most frequently include: results of operations, business overview, critical accounting policies, and liquidity and capital re sources.

sources.

During the first half of 2014, the market produced 132 initial public offerings (IPOs), the most robust six-month period since 2000 [1]. This rise in S-1 filings was reflected in the increase in comments on topics such as prospectuses and debt and equity financings.

CFGI assists clients with their SEC filings in order to minimize the likelihood of receiving comments by paying close attention to SEC focus areas and the adequacy of the company’s disclosures. Our tracking of SEC releases, industry sources and continued independent research allows us to stay abreast of the latest guidance and anticipate potential SEC comments related to key judgments by contemporaneously documenting the company’s accounting positions.

[1] Wilmer Hale June and Q2 2014 IPO Market Review, July 16, 2014