ASU 2016-02, Leases

On February 25, 2016, the FASB issued a long-awaited Accounting Standard Update to improve financial reporting around leasing transactions and more closely align accounting for leases with the recently issued International Financial Reporting Standard. The Update affects all entities that are participants to leasing agreements and most likely will represent significant transitional efforts.

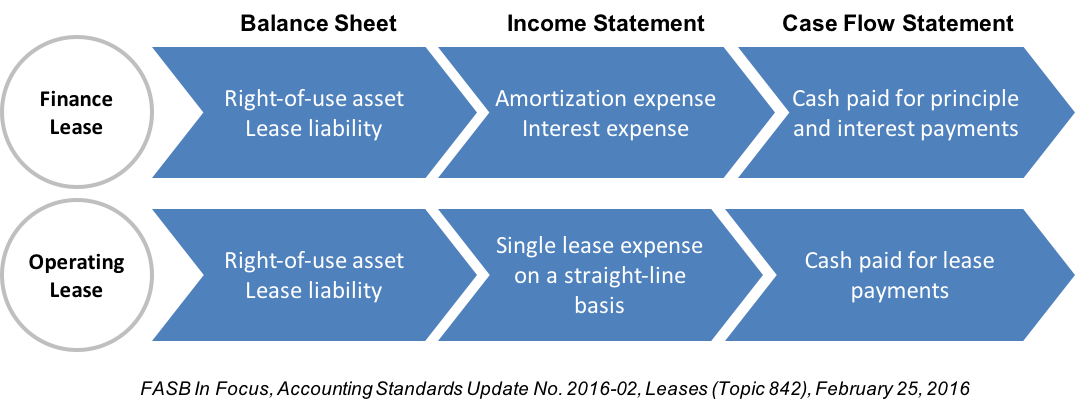

Lessee Accounting: The Update requires a lessee to recognize assets and liabilities on the balance sheet for operating leases and changes many key definitions, including the definition of a lease. The Update includes a short-term lease exception for leases with a term of 12 months or less, in which a lessee can make an accounting policy election not to recognize lease assets and lease liabilities. Lessees will continue to differentiate between finance leases (previously referred to as capital leases) and operating leases, using classification criteria that are substantially similar to the previous guidance. For lessees, the recognition, measurement, and presentation of expenses and cash flows arising from a lease have not significantly changed from previous GAAP. The FASB summarized lessee accounting treatment under the Update as follows:

Lessor Accounting: Lessor accounting will remain largely unchanged, except for targeted improvements to align with new terminology under lessee accounting and with the updated revenue recognition guidance in Topic 606.

Lessor Accounting: Lessor accounting will remain largely unchanged, except for targeted improvements to align with new terminology under lessee accounting and with the updated revenue recognition guidance in Topic 606.

Sale-Leasebacks: For a sale to occur the transfer must meet the sale criteria under the new revenue standard, ASC 606. Situations may exist where the transfer would have been considered a sale under the previous guidance but will not qualify under ASC 606, or vice versa. For those transactions that fail to meet the sales criteria under ASC 606, both the seller-lessee and the buyer-lessor will recognize the transaction as a financing. Entities will not be required to reassess transactions previously accounted for that were determined to be a sale under the previous guidance.

Disclosures: The Update includes additional quantitative and qualitative disclosures required by lessees and lessors to help users better understand the amount, timing, and uncertainty of cash flows arising from leases.

IFRS Comparison: The Update is not fully converged with IFRS 16, Leases, with the main differences relating to lessee accounting. IFRS 16 does not distinguish between finance leases and operating leases and requires leases to be accounted for consistent with the approach for finance leases in the ASU.

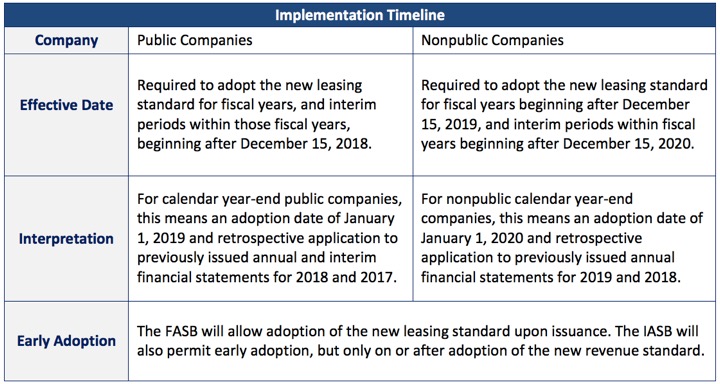

Transition: Lessees and lessors are required to recognize and measure leases at the beginning of the earliest period presented using a modified retrospective approach. The modified retrospective approach includes a number of optional practical expedients that entities may elect to apply as well as transition guidance specific to nonstandard leasing transactions.

How CFGI can help? With adoption for calendar year-end companies in 2019, there will be less than three years to think through the potential impact, particularly in light of the requirement to retroactively apply the standard to previously issued financial statements. CFGI can assist clients to assess information needs, impact on financial statements and covenants, assessment of system needs or modifications, etc. and help direct the implementation plan in the upcoming months, especially for clients with a large number of leases and/or multi-nationals.