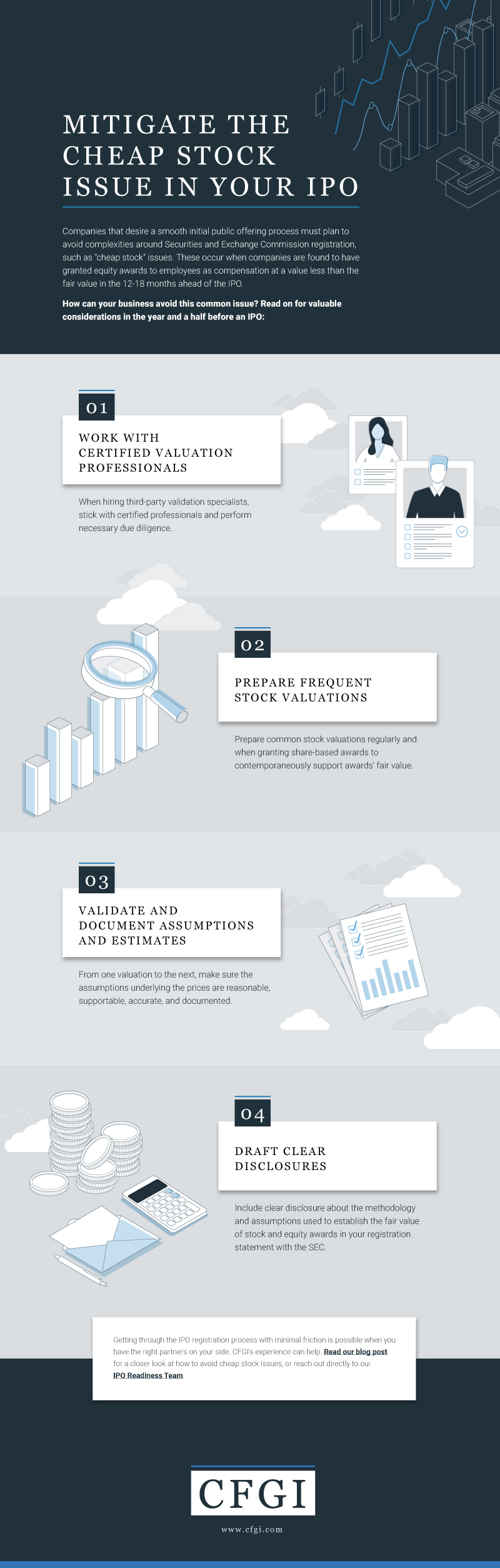

When a company embarks on an initial public offering (IPO), one of the most significant challenges in the registration process with the U.S. Securities and Exchange Commission (SEC) is mitigating the SEC staff’s concerns regarding “cheap stock.”

As companies prepare for an IPO, it is important to ensure that contemporaneous valuations are prepared with appropriate frequency to support the accounting for equity-based transactions, including the granting of stock-based awards. With the support of an IPO readiness team, companies can mitigate cheap stock concerns or, preferably, avoid them altogether.

What is cheap stock?

The valuation of equity awards issued to employees for compensation at a value that is less than fair value is considered cheap stock. In many instances, the fair value of equity awards granted in the 12 to 18 months prior to an IPO is lower than the price at which the same securities are sold in the IPO. The SEC continues to focus on this as a key accounting issue during an IPO to ensure companies accurately reflect compensation changes in their earnings.

How does the SEC determine if a company has a cheap stock issue?

During its review of an offering document, the SEC will focus on stock-based awards granted during the most recently completed fiscal year along with any subsequent interim periods. They will compare the midpoint of the estimated IPO price range, as disclosed in the company’s registration statement, to the weighted-average exercise price of equity awards granted during the periods under review. The SEC will issue comments asking the company to explain the change in value between the dates of recently granted equity awards and the date on which the midpoint of the estimated IPO price range is disclosed.

Generally, the estimated IPO price range is not disclosed in the initial filing of the company’s registration statement, which can make the timing of these comments problematic. Companies will typically disclose the price range in a subsequent amendment to the registration statement, after all other comments have been cleared, filed just prior to the start of the investor roadshow.

What can companies do to mitigate the risks associated with cheap stock comments?

In the 12 to 18 months leading up to an IPO, companies should partner with valuation professionals who can provide contemporaneous equity valuations in connection with significant transactions or events that impact the entity’s capitalization or enterprise value. These events might include financing transactions, significant product or business developments or breakthroughs, or large grants of stock-based awards to employees, directors or consultants.

Companies should consider the following when engaging third-party valuation specialists:

- Valuation standard: Companies should work with certified valuation professionals who adhere to the AICPA’s Accounting and Valuation Guide “Valuation of Privately-Held-Company Equity Securities Issued as Compensation.” Companies should perform an appropriate level of due diligence to become comfortable with third-party advisors.

- Contemporaneous valuations: Companies should perform common stock valuations at frequent intervals or on a basis contemporaneous with significant events or equity transactions. In relation to the granting of stock-based awards, valuations should be prepared as of the date of grant — or in close proximity to that date — to validate the exercise price of the awards. If not completed in advance of stock-based award grants, companies should perform valuations retrospectively to support the award value.

- Assumption validation: Companies are expected to validate the appropriateness of the assumptions and estimates underlying valuations, as well as the reasonableness of the assumptions and estimates from one valuation to another. The assumptions need to be reasonable, supportable and consistent with the company’s financial position as of the valuation date. The assumptions and estimates underlying the valuations must be supported by qualitative factors and developments within the business, industry and financial markets.

- Disclosure: The registration statement should include clear disclosures as to how the fair value of the company’s stock-based awards and the underlying stock were established. The disclosure should include a description of the valuation method(s) and key assumptions used in preparing the valuation and related calculation of compensation expense, as well as a discussion of any significant factors that contribute to the changes in the fair value of the company’s common stock between valuation dates.

In some cases, market conditions and/or other circumstances can result in a company beginning an IPO sooner than originally planned. This can leave the company with insufficient support for its accounting for stock-based awards over the most recent 12 to 18 months. In this situation, companies may need to consider engaging third-party valuation specialists to perform retrospective valuations covering key dates during the period subject to review by the SEC.

Regardless of timing or circumstances, it is important to assess the risk of a cheap stock issue early in the IPO process. Companies should prepare a preliminary analysis of their “valuation story” over the preceding 12 to 18 months. This should include an analysis of the stock prices used in accounting for stock-based awards. It should also consider factors such as:

- Third-party valuations, including valuation methods, key assumptions, estimates used and the timing (e.g. contemporaneous or retrospective).

- Any completed debt or equity financing transactions, or other changes in the company’s capital structure, including changes in the relative rights and preferences of the outstanding classes of stock.

- Changes or developments in the business during the review period, and any other relevant factors that would impact the company’s enterprise value.

- Other significant events.

In the event this analysis identifies a non-standard pattern that would call into question the appropriateness of the company’s assessment of the fair value of stock-based awards granted during the period, companies should take care to validate the appropriateness of the valuations and assumptions with its advisors and auditors. Companies may need to consider obtaining additional valuations and, where indicated, adjust the amount of compensation expense recorded during the periods subject to review by the SEC.

Companies should also consider engaging in a dialogue with the SEC early in the IPO process. Given the SEC’s practice of assessing and issuing cheap stock comments late in the registration process, often just as the company is beginning the investor roadshow, companies often send a confidential supplemental letter to the SEC prior to receiving any cheap stock comments. In these letters, companies will share the expected price range with the SEC ahead of public disclosure as well as provide the SEC a qualitative and quantitative assessment of the changes in the fair value of the company’s stock leading up to the IPO. This will allow the SEC to perform its review earlier and allow the company to respond to any comments before the start of the roadshow.

Companies should mitigate the risk of delay by identifying cheap stock concerns and addressing them in advance of filing a registration statement.

CFGI has significant experience assisting clients with securities registrations, including IPOs, and valuations of companies’ equity. This experience has deepened our knowledge and expertise with respect to the securities registration process and allows our clients to mitigate the risk of a prolonged exchange with the SEC at the time a company pursues an equity offering.

Our IPO Readiness Team is here to help.