Robotic process automation (“RPA”) is one of the latest buzzwords in technology, building interest and demand at a rapid clip. Mordor Intelligence’s recent trends report forecasts that the annual growth rate of the RPA market will increase by 26.9% in the next five years.

RPA isn’t another case of over-hyped tech that fails to deliver on its promise, though. The efficiency and productivity gains provided by RPA would be a boon to any organization. Private equity firms, in particular, stand to benefit by using this technology to create more value from their portfolio companies.

Looking around the private equity world, we have seen more firms take advantage of RPA to drive value and increase EBITDA across their assets by reducing overhead costs, cutting down on mundane processing tasks and reducing risk. If you haven’t already, be sure to include RPA in your value creation strategy.

Stay ahead of the curve with RPA

The past 12-plus months have been disruptive, to say the least. Although deal activity has moved forward relatively unscathed in the face of the COVID-19 pandemic, private equity firms have certainly had to rethink the best strategies to maximize EBITDA and returns from their portfolio companies. Every sector and industry has felt the global crisis’s impact, with some getting hit much harder than others. According to World Economic Forum and Freightos, global transit times lengthened by 25% (or more), reducing supply-chain efficiencies at every level.

In this unique environment, private equity firms are on the hunt for every opportunity to help their portfolio companies lower operational costs, cut unnecessary items from annual budgets and boost long-term financial performance expectations. In fact, according to Research and Markets’ 2021 Robotic Process Automation Market Research Report, the global RPA market’s value could increase from $2.1 billion in 2020 to $46 billion by 2030.

Implementing RPA to automate repeatable tasks that would otherwise require dozens of hours of manual work is a great — and relatively straightforward — way to achieve better cost-savings and value creation. RPA is a comparatively lightweight technology that sits on top of your existing infrastructure, which makes it easy to quickly deploy and manage. Think weeks, not months.

Expect RPA projects to increase in number and scope for the foreseeable future as firms look for opportunities to reduce operating budgets while increasing the long-term value of portfolio companies.

Start with quick wins — then build for the future

Finance is a natural entry point for RPA since there are numerous repeatable processes that take up a lot of time. A business transformation assessment will likely bring to light several places within the finance organization to get started, but RPA can be applied to almost every department and business unit. For the sake of quickly increasing the value of portfolio companies, it makes sense to focus on low-hanging fruit first before taking on more complex projects. Automating routine jobs like compiling information for monthly financial and operational reports or vendor invoices can deliver an immediate impact to the company. From our team’s experience, every company has at least three or four quick wins with RPA that would be easy to implement from both a cost and time perspective.

Once you have a foothold within the organization, you can begin expanding RPA to different lines of business to generate more productivity and efficiency gains across the entire business. With some adjustments, RPA software robots can be applied to similar processes at other portfolio companies, creating more value for your firm. The right implementation strategy can conceivably add $1 million or more to the value of every asset in your portfolio.

Having laid that foundation, firms can then look for ways to incorporate more sophisticated software robots that take on complex tasks beyond the scope of baseline RPA. Incorporating advanced technology like intelligent document processing and machine learning opens up more possibilities for bots to solve strategic problems. With each successive implementation, firms can steadily drive efficiencies within their portfolio companies, making them more appealing to potential buyers.

RPA also sets up firms to transition to the workforce of the future where employees and software robots work together to complete tasks. Taking these steps forward today will position you for long-term success.

What does the RPA implementation process look like?

Private equity firms need to be judicious about where they apply RPA to ensure they drive the most value from their assets. CFGI’s private equity and RPA experts have conducted numerous implementation projects, creating a repeatable roadmap for successfully introducing this technology in any environment.

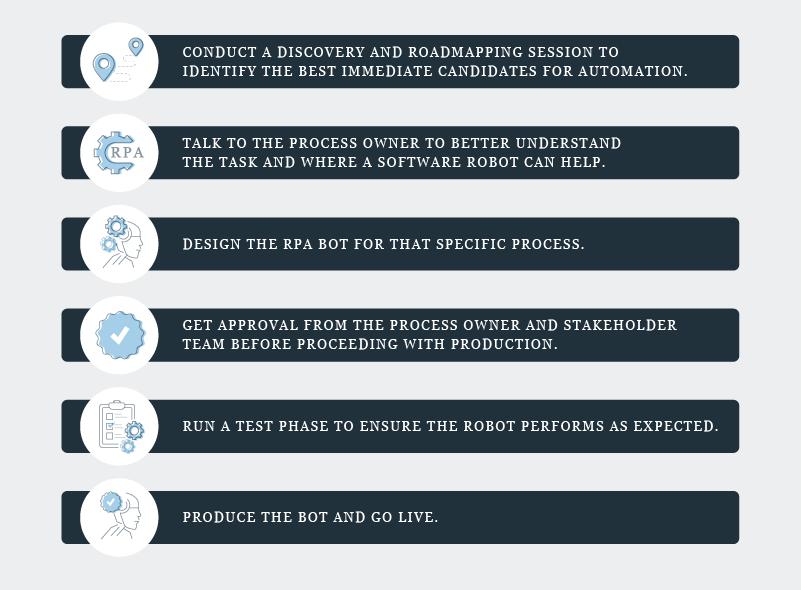

- Conduct a discovery and road mapping session to identify the best immediate candidates for automation.

- Talk to the process owner to better understand the task and where a software robot can help.

- Design the RPA bot for that specific process.

- Get approval from the process owner and stakeholder team before proceeding with development.

- Run a test phase in a non-production environment to ensure the robot performs as expected.

- Produce the bot and go live.

Depending on the complexity and proper internal business support, RPA bots can be built in a matter of weeks, not years. Furthermore, the active time for stakeholder teams is even less, quite possibly only a few hours. CFGI’s approach to RPA has been steadily refined and streamlined to provide the most impact with the shortest possible lead time.

If you’re looking for a competitive edge — and who isn’t? — RPA is a low-cost way to drive EBITDA in one or several portfolio companies. There are countless applications for this technology, and once you have a solid footing, you can expand it to more processes across the enterprise.

Watch our new RPA video to learn more, or reach out to our private equity team to schedule a discovery session.