There’s no doubt that increasing the value of a portfolio company is an intricate process, and each company brings unique challenges. Understanding what levers to pull and when can be a resource-intensive task. However, PE firms can augment their deal-making expertise with the business transformation skills of an advisory partner to drive operating efficiencies (and EBITDA).

At a high level, EBITDA optimization should always center around the people, processes and systems of acquired companies. Focusing on these three areas allows PE firms to make strategic decisions that lead to measurable outcomes. With support from a trusted transaction advisor, PE firms can achieve their goals with greater efficiency, enabling them to exit their operations within a reasonable timeframe.

Preparing a roadmap to the future state of the organization

The first step to EBITDA optimization is to understand where the company is today. Then, leadership can look ahead to the ideal future state of the organization, and work backward to identify the improvements necessary to enact value creation initiatives.

PE firms need a plan for improving the people, processes and systems within each portfolio company, but where to start? With support from a transaction advisor, PE firms can gain access to proven diagnostic tools and expert analyses to aid the accurate identification of areas of improvement. An experienced advisory partner can lend its technical expertise to quickly resolve accounting and finance issues. For example, consulting professionals can take on essential management positions, including the role of CFO, to quickly and effectively operationalize the PE firm’s synergistic objectives.

Without this support, PE firms risk losing momentum after the deal closes. Activities conducted during the first 100 days are critical to achieving long-term objectives. Planning for the future state of the organization — and forecasting exit scenarios — can ensure the organization is on the right track. Rapid analysis of the company’s current state enables PE firms to hit the ground running.

Examples of EBITDA optimization

Rapid Transformation Assessments can provide a clear picture of the various levers available to pull that can enhance company performance. With a holistic understanding of what is within a company’s control, leadership can take informed, decisive action to prioritize and sequence improvement opportunities and accurately measure performance along the way.

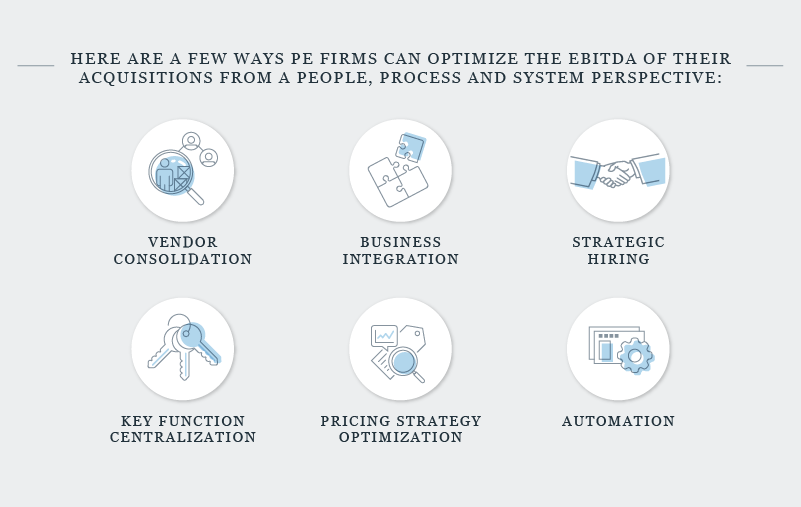

Here are a few ways PE firms can optimize the EBITDA of their acquisitions from a people, process and system perspective:

- Vendor consolidation: Portfolio companies can achieve scale by consolidating vendors, which reduces process and purchasing costs. In addition, strengthening the relationship with a single vendor can lead to further long-term benefits.

- Business integration: When combining add-on acquisitions with a platform company, PE firms have the opportunity to identify and eliminate redundancies.

- Strategic hiring: In cases where the acquisition lacks the experience necessary to scale, the PE firm can leverage interim management, training programs and controls to boost the level of professionalism across the organization.

- Key function centralization: With add-on acquisitions, there’s always an opportunity to centralize key functions to gain new efficiencies. Reducing redundant processes frees up more bandwidth for growth activities.

- Pricing strategy optimization: With the support of a finance advisor, PE firms can quickly analyze and optimize the company’s pricing strategy to better reflect its position in the marketplace.

- Automation: Emerging technologies such as robotic process automation can complete repetitive manual tasks faster and more accurately. This frees up personnel to reallocate their time and attention to value-add tasks.

Whatever levers the PE firm and management decide to pull, it is critical to be able to measure the outcomes of its plan of action to ensure it stays on track with achieving objectives within the desired timeline.

Leveraging KPIs to support and reinforce optimization efforts

PE firms possess strong deal-making capabilities and they have a sound understanding of what’s needed to operationalize each acquisition. However, there can be a disconnect between the strategic plans that drive investment and the company’s ability to effectuate the changes needed to grow and improve. Key performance indicators (KPIs) provide meaningful metrics that enable the firm to understand what levers to pull, rather than simply reacting to conditions as they occur.

By setting up a financial planning and analysis function, PE firms can establish reporting on KPIs to view trends on a daily, weekly, monthly or quarterly basis. This allows leadership to make better decisions over time and operate proactively.

For example, gross margins can only tell leadership so much. It’s necessary to dig deeper into what drives that figure — which usually includes pricing structure, discounting ability and related factors. Measuring those upstream KPIs creates a wider view, enabling a better understanding of the sales pipeline and conversion process (i.e. tracking leads as they come in the sales funnel and looking at how they convert). Creating visibility into these key drivers of the business allows for more intelligent decision-making. KPIs should support department heads in their strategic decision-making. An experienced advisory partner can help to define those KPIs and establish a beneficial reporting process.

EBITDA optimization is just one piece of the puzzle that is value creation. A comprehensive finance transformation strategy is needed to deliver the best possible results. Our whitepaper explains how finance leaders can navigate organizations through periods of rapid and disruptive change.

Want to learn more? Please reach out to Barry Smith, Partner (610-420-6635, bsmith@cfgi.com), Grant Newmyer, Managing Director (724-243-5838, gnewmyer@cfgi.com) or Robert Winslow, Partner (203-482-9764, rwinslow@cfgi.com).