Beginning January 1, 2017, Public companies will need to implement the amendments to the share-based compensation guidance contained in the FASB’s issuance of ASU No. 2016-09 “Improvements to Employee Share-Based Payment Accounting”. The FASB’s stated goal with the release was to provide simplification amendments based on industry feedback the FASB received through its open deliberation process.

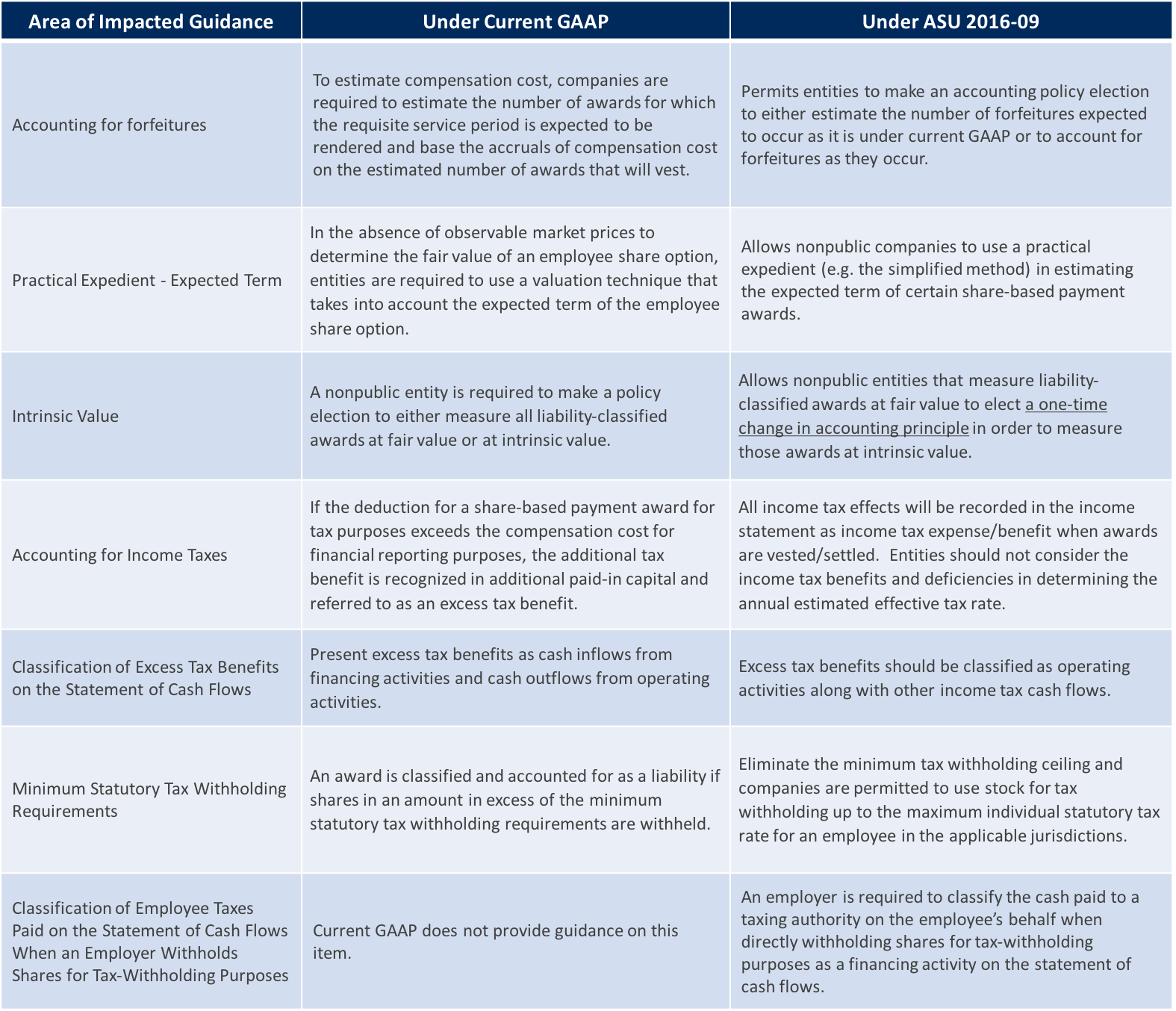

Public companies with calendar year-ends should have a clear adoption plan in place as they enter this reporting season and be ready to implement some of the changes provided under the amendment. As we assist in developing adoption plans, we are working closely with clients on the following summary of key amendments provided in the new guidance:

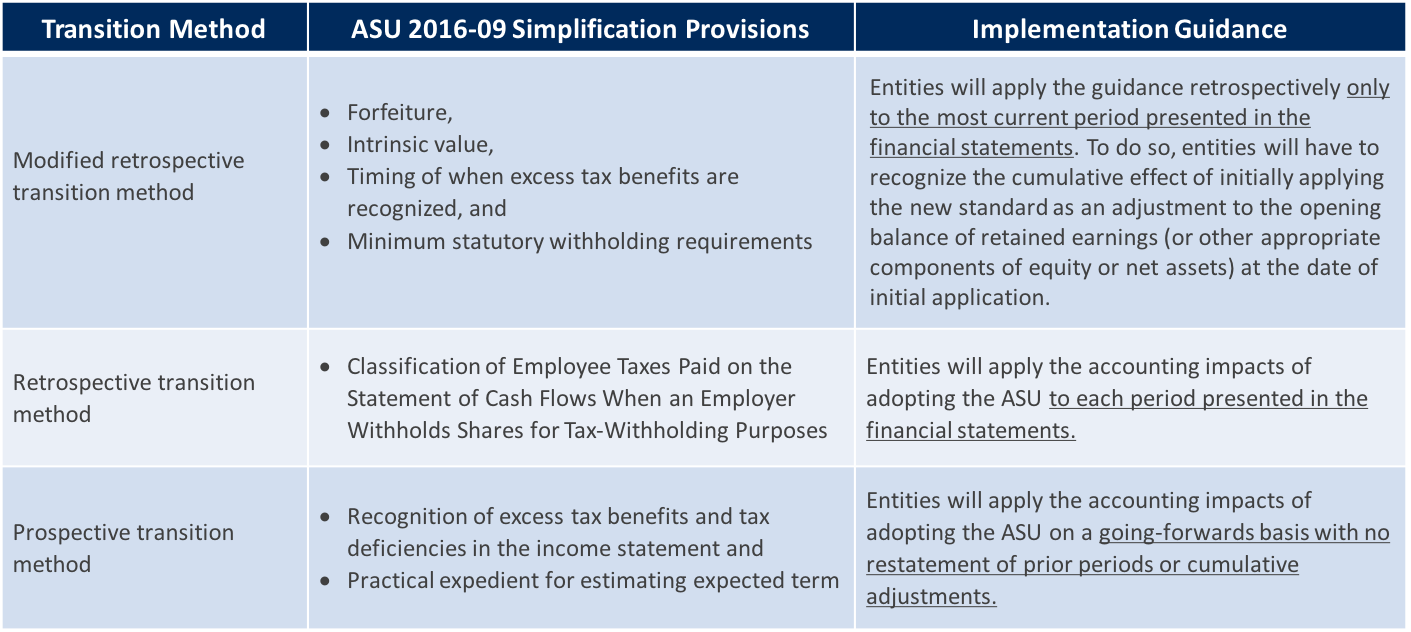

TRANSITION REQUIREMENTS

EFFECTIVE DATE

For public business entities, the amendments are effective for annual periods beginning after December 15, 2016, and interim periods within those annual periods. For all other entities, the amendments are effective for annual periods beginning after December 15, 2017, and interim periods within annual periods beginning after December 15, 2018.

Early adoption is permitted for any entity in any interim or annual period for which the financial statements have not been issued or made available to be issued. If an entity early adopts the amendments in an interim period, any adjustments should be reflected as of the beginning of the fiscal year that includes that interim period. An entity that elects early adoption must adopt all of the amendments in the same period.

NEXT STEPS

The objective of the simplification Initiative is, among other items, to reduce the cost and complexity associated with accounting for share-based payments, the adoption of which may lead to increased volatility in reported earnings. We encourage companies to evaluate the impact of this ASU on their financial reporting. CFGI can assist clients with performing assessments, understanding information needs, updating documentation, communicating potential changes to management and auditors, and helping direct the transition plan.