A reintroduction to xP&A

As it’s traditionally defined, financial planning and analysis (FP&A) is the set of activities that support a company’s financial health: integrated planning and budgeting, management and performance reporting, and forecasting and modeling.

This strict definition is well suited to a finance function of years past, but there is a growing consensus that the role of FP&A has expanded to be the driver of continuous financial and operational planning for entire companies. Gartner has termed this expanded definition and scope of FP&A as “xP&A,” or “extended planning and analysis.” By 2024, Gartner expects that 70% of FP&A projects will become xP&A projects.

But what exactly is xP&A, and how is it different from traditional FP&A?

With xP&A, a comprehensive view of the business is created by unifying each department with common goals based on integrated, meaningful metrics, resulting in a more efficient planning process overall.

Simply stated, xP&A drives value by connecting operational aspects of the business directly together, linking your HR, IT, sales and marketing departments with their financial outcomes. This methodology aims to resolve one of the most common pitfalls in traditional FP&A departments: a lack of continuous planning and analysis at the operational level.

The importance of xP&A in today’s competitive business climate

The xP&A approach tackles some of the leading challenges today’s CFOs face, such as doing more with less and keeping pace with change. By maintaining an operational focus for your FP&A workforce, this function can translate the critical capabilities of your business into action items, with the potential to reduce costs in the process.

In addition, transforming into a digital finance function that embraces technology means you’ll save time and benefit from a leaner workforce. At a minimum, this team will still be able to reach similar heights, potentially achieving even greater and more impactful outcomes, all while using fewer resources.

In theory, the core methodology of extending your planning and analysis function to the operational layers of the business is not new. However, the implementation and execution of this strategy can prove to be difficult for a majority of companies.

So, how is it possible to fully transition a standard FP&A function to one that embraces xP&A?

First, it’s vital to have a clear understanding of the role FP&A plays in your company today and to identify the headwinds that prevent it from becoming the hub of operational planning.

Second, embracing change and getting buy-in throughout the company will be critical.

Finally, you’ll have to envision how the new design will look in a future state and execute on key initiatives to transform your existing company into one that benefits from xP&A.

The effort required for this transition can be significant, but for a thriving business, it’s absolutely invaluable. As the team takes on more meaningful work that benefits each aspect of the company, the value of this transformation will become abundantly clear.

Common shortcomings of today’s FP&A functions

In its current state, the prevailing design used for today’s FP&A functions is incapable of achieving the level of value captured by xP&A. This is due to a number of factors, including:

- A limited understanding, at the operational level, of finance’s role in the overall planning strategy.

- Siloed departments, which limit transparency and hinder understanding of various operational processes while also obscuring the data that’s being captured.

- A “check-the-box” mentality that does not derive insights from the planning process.

- A lack of investment in technology and inefficient process design.

- A heavy reliance on spreadsheets and manual processes to handle all aspects of the planning life cycle.

- Individuals performing skilled work without proper training.

Any one of the above factors could open the door to a myriad of problems that inherently limit FP&A’s ability to derive insights and drive strategy.

The effect of potential FP&A shortcomings

The ambiguity surrounding a company’s strategic goals and a lack of transparency can disincentivize operational stakeholders from providing accurate projections. As a result, FP&A struggles to validate that the numbers align to tell a single cohesive story. Operational and financial key performance indicators become disconnected and fail to highlight measures of success.

Simultaneously, misused technology, or a lack of investment in new solutions, could result in tedious and inefficient manual processes that squander time and resources for the finance function. As a result, team members are often exhausted and struggle to connect finance’s vision to its value, since much of their time is spent on administrative tasks, such as rolling forward files and ensuring a single source of truth.

These inherent flaws within traditional FP&A operations have major consequences for your company’s ability to provide accurate, insightful and meaningful projections in a timely manner. Shortcomings will expand as your company grows and should be addressed in order to pursue an xP&A approach.

Embracing change and getting buy-in from all parties

Change can be difficult.

At first, transitioning from legacy processes to new methods and technologies can effectively double the workload for users on both the front and back ends.

System implementations require ample time for vendor evaluation as well as coordination and alignment with IT to integrate new technologies within the current tech stack. The shift also demands a clear understanding of how processes can be optimized by new methodologies.

Employees may also be concerned about job security. This is due to the implementation of new process redesigns and automation updates that take over what were once everyday tasks.

While these scenarios may deter some companies from embracing change, forward-thinking businesses have to accelerate processes where data is created and captured in order to improve decision-making.

Change doesn’t happen in a vacuum

Fortunately, these hurdles can be overcome, and the results are definitely worth it.

When you work with key decision-makers throughout the company, changes implemented within one unit can be aligned with shared, overarching goals. The need for change is then accepted among all parties involved, and members begin to actively participate in driving change. Methodologies such as Prosci’s ADKAR® model can help companies not only embrace change, but also work together to achieve common goals:

A – Individuals are aware of the need to change.

D – Individuals have the desire to change.

K – Individuals have the knowledge to effectively implement change.

A – Individuals have the ability to change.

R – Change is reinforced so that individuals strive to continuously implement change.

By following these core concepts, business leaders, along with their teams and counterparts, can work cross-functionally to achieve a holistic goal of implementing change and discovering new ways of working. This approach fosters an environment that leverages data-driven business practices powered by transparency and collaboration across different functions.

Teams feel the connection between their personal aspirations and the goals of the company at large, and they have the ability to create a larger impact on business operations. By remaining adaptive and accepting of change, companies can position themselves to achieve the full scope of business partnership advantages delivered by xP&A.

Creating a roadmap to the future state design

Now that we’ve identified the most common issues affecting FP&A groups and addressed the need to embrace change, it’s easier to identify what “good” looks like and begin the transformation journey.

But where do you start?

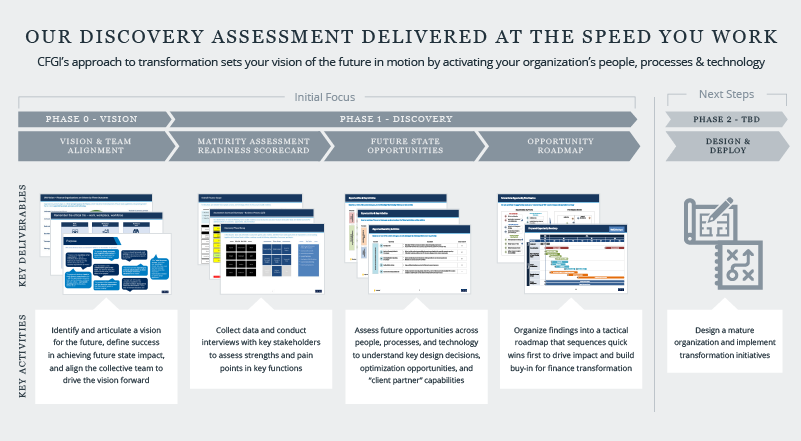

Having a transformation roadmap builds confidence that your objectives are thoughtful, validated and achievable. Our rapid discovery assessment, which focuses on people, processes and technology, can help you identify where your FP&A organization can benefit from transformation.

By conducting a wide-ranging analysis of your operations, you can ensure that you’ve adequately reviewed all facets of your business. As a result, your company will be able to achieve success in the following areas and communicate where value was created across each sector:

|

People |

Processes |

Technology |

|

|

Vision |

Articulate the ways in which FP&A creates and captures value for its key stakeholders using a methodical validation of your value proposition. |

||

|

Design |

Processes are efficient, meet the needs of all stakeholders and provide meaning to employees. |

Digital technology expedites the flow of work via automation and provides insights from data using advanced analytic capabilities. |

|

|

Capacity |

Proper staffing ensures that all tasks are completed in an accurate and timely manner. Work is properly allocated to reduce the risk of burnout. |

||

|

Skills |

Individuals have strong soft skills to effectively partner with operational and financial stakeholders. |

Individuals have strong technical skills to perform tasks and feel confident in the process. |

Individuals know how to or have the ability to upskill on leading tech platforms to optimize their use of time. |

|

Business Case |

Individuals dedicate more time to learning the business and how the company operates via business partnering. |

Individuals are upskilled, feel a sense of purpose in the work and gain transferable skills. |

Digital technology relieves individuals from tedious workloads and establishes a single source of truth. |

|

Value Assessment |

Process optimization and digital technology help cut the amount of time it takes to perform administrative tasks, resulting in a potential reduction in resources required to do the work and added insights that are repeatable and scalable. Enhanced FP&A workflows provide a deeper understanding of core operations, which can help create synergies among different parties to drive business strategies forward. |

||

Who benefits from this form of transformation?

First, after undertaking this kind of change, your FP&A team will be equipped with dedicated people, optimized processes and leading technologies to help complete the required work at peak performance.

Second, executive leadership will see a return on their investment from the transformation initiative by accelerating the ability to make data-driven business decisions and reducing the time in which processes are performed.

Finally, operational stakeholders also benefit, since they gain a dedicated finance business partner that has a core understanding of their departmental initiatives and increased transparency concerning how their work translates to financial outcomes for the business.

In this way, all three parties become united in their efforts to drive growth, improve strategies and achieve success.

Redefining work with xP&A

Implementing a personalized design for the future state of your company yields both tangible and intangible benefits. Through these efforts, FP&A can focus on analyzing how changes in operational data impact financial performance.

FP&A acts as a bridge that connects operational and financial stakeholders through its unique ability to capture data and drive business decision-making. As a result, FP&A leaders are better able to assess which assumptions weigh most heavily on the core growth of the company.

As you use the prism of xP&A to redefine how your team members conduct their work, it will become evident that cross-collaboration efforts only increase your potential to truly understand what drives success for the company.

How CFGI can help

CFGI’s Financial Planning & Analysis solution is ideally positioned to help bring your business to a state where you can capitalize on the benefits of continuous financial and operational planning. Because we believe that traditional FP&A tasks will become increasingly standardized and automated as strategic finance grows in size and visibility, our FP&A solution employs an xP&A perspective. With our extensive financial knowledge and wide-ranging experience with industry and client service, CFGI can help your company enter this next phase and drive business value while leaving day-to-day operations uninterrupted.

If you are interested in discovering more about CFGI’s Business Transformation services related to Financial Planning & Analysis, please contact Rob Winslow, Partner (rwinslow@cfgi.com, 203-482-9764) or Igor Stelea, Senior Manager (istelea@cfgi.com, 617-372-3360).