Buy-and-build strategies, where PE firms acquire a platform company and then make synergistic investments in smaller companies, have grown in popularity in recent years.

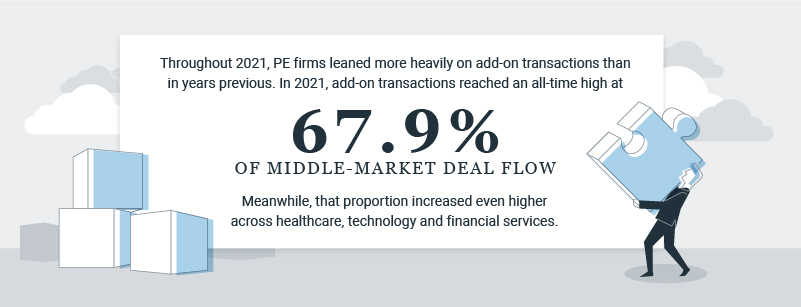

Throughout 2021, PE firms leaned more heavily on add-on transactions than in years previous. In 2021, add-on transactions reached an all-time high at 67.9% of middle-market deal flow. Meanwhile, that proportion increased even higher across healthcare, technology and financial services.

Ultimately, add-on transactions can facilitate strategic objectives, including EBITDA growth and optimization. However, add-on acquisitions also bring their own risk. PE firms require the right tools, experience and expertise to gain the operational insight needed to create value through add-ons.

Trend: PE firms and add-on transactions

Why are add-on transactions so popular? The trend has been growing steadily in recent years, as PE firms acquired the tools and knowledge to accurately assess synergies inherent in add-on transactions. By targeting smaller companies, PE firms can increase the value of the combined entity by: (a) taking advantage of the arbitrage created by the acquisition multiple and the presumed exit multiple and (b) planning and implementing operating synergies post-closing.

Analyzing synergistic opportunities requires a keen understanding of the people, processes and systems that drive the platform company’s growth. When approaching add-on transactions, PE firms may experience friction in several areas:

- The operating company may not have the expertise to conduct financial due diligence.

- The PE firm may lack accounting resources.

- The PE firm may not have the ability to reconcile GAAP and non-GAAP accounting methodologies to complete required post-closing purchase accounting.

Getting support from a trusted transaction advisor can reduce these risks and help PE firms make sound decisions. An advisor can ensure that add-on entities are properly valued. Because operating companies may lack technical accounting expertise, a third-party can evaluate an add-on entity’s potential value. An advisor can highlight gaps that may present opportunities for future growth, as well.

Taking a systematic approach to transaction assessments can not only reduce the risk of inaccurate valuation, but also unlock more synergies. Advisors with a keen understanding of finance transformation trends can define actionable roadmaps for achieving value creation.

Optimizing transactions: People, process and technology

With the support of an experienced transaction advisor, PE firms can move faster while gaining key efficiencies.

The most common challenge portfolio companies face is a lack of bandwidth needed to develop operational efficiencies while simultaneously incorporating the financial results of add-on transactions into existing reporting requirements.

For example, let’s say a PE firm uses debt to purchase 20 companies, but lacks a standard process with which to integrate the companies’ financials. With an end-of-year external audit on the horizon, and bank covenants to honor, the firm faces the difficult challenge of prioritizing reporting requirements while also executing its growth strategy. If the firm misses its reporting deadlines, it creates a serious risk of loan recalls. Meanwhile, the firm’s team members will feel the stress of getting pulled in too many directions as the firm attempts to meet its timelines to exit operations. At that stage, an independent advisor can help by creating a common chart of accounts for all acquired companies that align with the purchasing company’s chart of accounts and immediately begin the work to integrate reporting into a single package.

During the diligence phase of transactions, the level of effort required post-closing should never be underestimated. After all, that’s when the real work begins. By including rapid diagnostic tools during diligence, with a lens towards the all-important “first 100 days”, PE firms can proactively plan for attacking post-closing challenges. To maximize efficiency — especially when planning several add-on acquisitions — the diligence phase requires some level of standardization and heightened focus on people, financial processes and technical systems.

People

Common issues related to talent strategies during add-on transactions include:

- Lack of bandwidth and standard processes to manage new financial reporting requirements.

- Lack of technical accounting expertise.

- Lack of integration planning.

It’s common for the financial function of an acquisition to not be up to par with the standards of a PE firm. When that’s the case, outside resources may be necessary to ensure timely financial integration.

Process

Without standardized reporting processes, integration timelines can drag out, management stress levels can elevate and friction with the financial sponsor can ensue. PE firms require regular data and analysis to properly manage their investments, as do PE lenders. Without standardized reporting processes, newly acquired portfolio companies can become disruptive and cause delays. For example, PE firms need to harmonize accounting policies and procedures, aligning new acquisitions with the platform company.

Technology

Technology discrepancies between companies can lead to bottlenecks that slow down the integration process. For example, if the platform company uses Microsoft Dynamics, but new acquisitions use Quickbooks, it will take some time to get these systems integrated. Not only is strong financial expertise required, but also IT competencies. PE firms should have a plan in place for dealing with technology gaps so they move toward a standardized approach as quickly and accurately as possible.

5 questions to ask your transaction advisor

With the right transaction advisor, PE firms can properly plan, execute and manage their buy-and-build efforts. Asking these questions will help you understand more about how an advisor can support your strategic objectives:

- How have you helped PE firms drive operating efficiencies (and EBITDA) in their portfolio companies?

- How do you help PE firms after the diligence phase?

- Can you help us assess the company’s ability to meet our new stakeholder reporting requirements?

- What level of effort will be required to conform to our existing stakeholder reporting requirements and timelines?

- Where there are gaps, can you provide additional support post-closing?

There’s no doubt that PE firms today face a very different financial landscape than in the past. Download your complimentary copy of our recent whitepaper “On the Clock: The Future is Already Here, and CFOs Need to Transform Finance to Survive” to find out more about these trends.

Interested in learning more? Get in touch with Matt Estadt, Partner (mestadt@cfgi.com, 215-284-0535) or Barry Smith, Partner (bsmith@cfgi.com, 610-420-6635).