Carve-Out Management and Support

Driving success of complex carve-out transactions at every stage of the transaction lifecycle

The success of the underlying divestment or acquisition of a carve-out often will depend upon the successful execution of the carve-out itself. The experience required to navigate the planning of a carve-out, the governance needed to manage the conflicting priorities of many stakeholders, and the resources to execute on the carve-out plan often are beyond even the largest and most sophisticated Sellers and Buyers.

That’s where CFGI comes in.

CFGI represents a unique blend of capabilities and experience to help plan, manage, and execute even the most complex carve-outs. Driven by leading practices, proven approaches, and supported by skilled professionals from across the breadth of CFGI, we help Buyers and Sellers, and their sponsors and advisors, navigate the complexity of carve-outs throughout the transaction lifecycle with the goal of minimizing risks and maximizing returns for all parties involved.

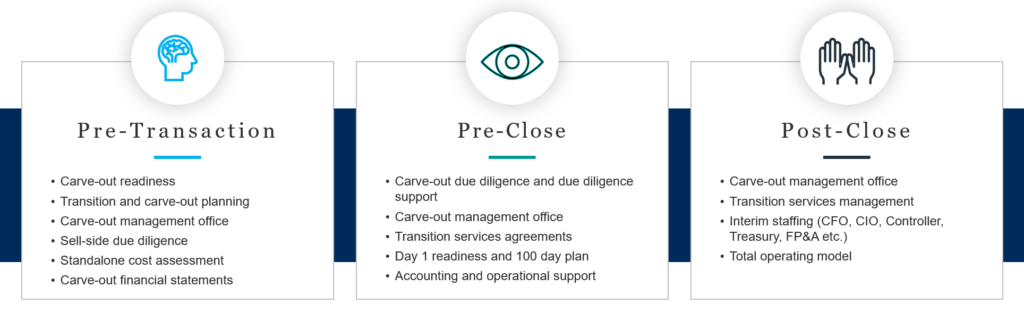

CFGI’s Carve-out Management and Support At-A-Glance

Positioning carve-outs for success

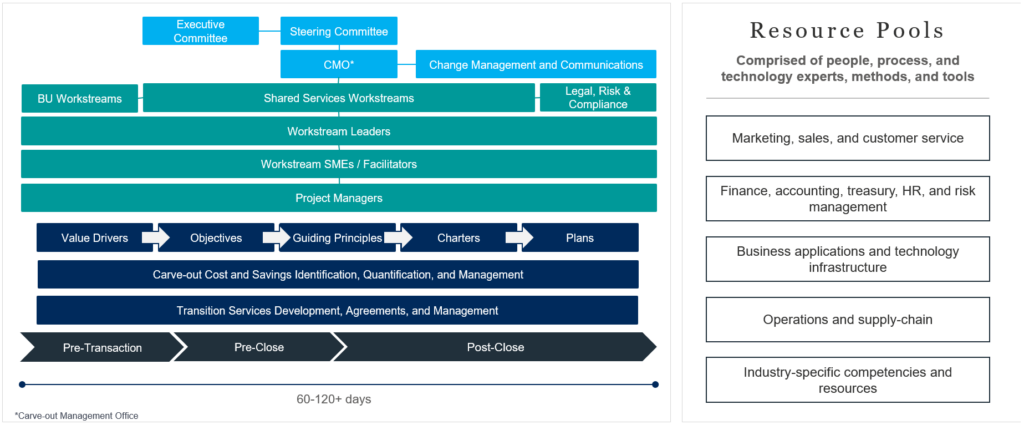

Critical to the success of all carve-outs is the Carve-out Management Office (CMO). Far more than a program management office, the CMO embodies a comprehensive governance structure and a proven process that addresses every aspect of planning, managing, executing, and supporting a carve-out. Led by a CMO Director, typically with decades of industry-relevant carve-out experience, the CMO also incorporates carve-out specialized program and project management, change management, and communications management resources necessary to bring a carve-out to a successful conclusion.

CFGI’s capabilities to support carve-outs do not all reside within the CMO. Our clients are also supported by a pool of expert resources from across CFGI and our most trusted partners who can roll up their sleeves and play a hands-on role in the execution of the carve-out. These expert resources may be involved as on-demand advisors, consultants working on specific aspects of the carve-out, or as interim resources supplementing and working as part of the Buyer’s or Seller’s teams. All expert resources work under the direction and supervision of the CMO to ensure seamless delivery and a consistent focus on our client’s objectives for the carve-out.

CFGI’s Carve-out Governance, Structure, Process, and Resource Pools At-A-Glance

The CFGI difference

There are many excellent advisors in the marketplace that support carve-outs, but CFGI stands out for a variety of reasons:

- The ability to help execute carve-outs in addition to their planning, management, and support reduces the need for our clients to identify, engage, and oversee multiple service providers.

- We partner with and augment your deal, operating, and carve-out teams’ pre-transaction, pre-close, and post-close efforts with skilled and experienced personnel, specialized services, and a proven carve-out to avoid duplication of effort.

- We treat every carve-out as a unique undertaking, taking into consideration the divestment or investment thesis, the industry, and the proposed structure for the transaction. We then draw from and combine CFGI’s capabilities that will best address our client’s needs. This keeps our focus on helping our client bring the carve-out to a successful conclusion.

- Our approach leverages a senior-level delivery model which means our partners, managing directors, and other key engagement team members are accessible and responsive as needed. This allows CFGI to focus on bringing all the firm’s capabilities to bear in the appropriate measure and at the right time to help your carve-out be even more successful rather than managing junior staff.

The value of our experience

CFGI and our team have worked on some of the largest and most complex carve-outs for some of the largest clients in the world, across the globe, and in almost every industry. Each carve-out is a learning experience and provides invaluable perspective we can leverage on subsequent carve-out efforts – including yours.