Times of uncertainty can present opportunities to think about M&A differently.

While the pandemic has had a significant impact on the global economy and shed new light on the digital divide, treading the waters of uncertainty is nothing new in M&A (which tends to be a leading indicator of economic cycles), or for the 21st century in general.

At CFGI, we believe that capturing deal value shouldn’t be limited to times of certainty, and that for some companies, there may be a need to reevaluate their transaction strategy, from revamping their approach and resetting baselines to refining the way they report and forecast. With the benefit of the global pandemic shedding light on foundational cracks, there may even be opportunities to improve the way some companies operate with the right integration strategy.

Revamping the approach

Assessment and logistics

COVID-19 has impacted the M&A process in a variety of ways: Risk-averse companies are pulling back investments and financing while risk-tolerant companies, specifically those that adapted to the changing economic landscape more swiftly, are looking for ways to spend additional capital on hand.

Dealmakers should anticipate an elongated M&A process. From contract negotiations to more stringent lending policies, company stakeholders will be understandably more cautious and diligent while navigating the various degrees of global uncertainty to protect deal value. Specifically, tremendous scrutiny is sure to be placed on business operating models and whether or not they are equipped to handle the industry paradigm shifts brought to the forefront by COVID-19. It is important that buyers and sellers understand how their industries have changed as a result of the public health crisis, whether these changes are temporary or permanent, and how these changes impact overall business strategy going forward. Some key questions to consider include:

- Are previously considered deals still viable in the current economic climate? In other words, buyers and sellers should rethink whether acquisitions/divestitures considered pre-pandemic still make economic sense based on how both parties’ industries have shifted and the resulting business impacts from such changes (i.e. supply chain disruptions, remote work expansion, rise of digital technologies, etc.)

- What opportunities exist as companies look to spend stockpiled cash generated during the pandemic? Many companies have held off on traditional methods of providing returns to shareholders, such as share-repurchase programs and paying dividends, in an effort to stockpile cash so that core business operations can continue to be funded even during economic uncertainty. With stockpiled cash on hand and business operations stabilizing, these organizations are looking to put capital to work.

- Have certain industries shifted in such a way that an acquisition or divestiture is now necessary to maintain a competitive advantage? The most prominent example that comes to mind in this situation is Uber, where its core offering of ride-hailing services declined approximately 75% from a gross bookings perspective in Q2 2020 relative to Q2 2019. Alternatively, Uber’s gross bookings from delivery, aka its UberEats platform, doubled over the same period. As a result of this industry shift (i.e., more consumers staying home and ordering delivery and fewer people going out for social interactions on a daily basis), Uber looked to double down on its delivery business with the acquisition of Postmates for $2.65 billion. Expect many other organizations operating in multiple product lines to hedge struggling business units by bolstering those currently thriving amid the “new normal.”

These uncertainties drive the need to rethink everything we know about acquisitions and divestitures, from deal logistics and approval delays to assessing core business drivers and the approach to valuation. Achieving that level of insight may require deeper analysis beyond existing deal review and assessment processes.

Adjusted baselines and deeper KPIs

To bridge the purchase price financing gap in a world of newfound economic volatility and uncertainty, familiar considerations centered on deal logistics such as regulatory approvals and non-compete agreements for key employees are imperative. Also, deeper contingencies meant to preserve and drive deal value will be built into the deal structure milestones such as cash flow covenants, revenue and EBITDA targets, and bookings and subscription metrics.

The increase in milestone contingencies reflects the need for companies to prove they can achieve the results that have been promised, so maintaining a standalone reporting environment is imperative. Things can get muddled with data, which is why it’s important to forecast within the company’s timeline, degree and budget.

How does this get companies (and how can they move the baseline) to accurately measure, report and improve the business? And what are they measuring against? Reevaluating the baseline is vital to ensuring an accurate starting point to measure against. Establishing deeper KPIs from the start will help companies more effectively measure, track and drive insights into the organization’s bottom line:

- Quality of earnings: In identifying potential EBITDA impacts and analyzing sustainable earnings, adjustments may include non-recurring revenues or expenses, pro forma adjustments and assessment of management adjustments for reasonableness.

- Sale and purchase agreement (SPA): Focus on accounting definitions and purchase price adjustment mechanism (including indebtedness and working capital peg).

- Net working capital: Better understanding of operating cash flows may support company efforts to negotiate target working capital and SPA adjustment mechanisms.

- Debt: Identification of items which will impact equity valuation and future cash-flows.

A “new” baseline helps forecasts take into consideration any new financial or non-financial changes and accurately reflects the economic environment going forward while providing a more realistic starting point to measure against.

Dynamic forecasts for every scenario, and every stakeholder

While reporting tells stories of what happened in the past, forecasts should reflect decisions about the future. It should not take a pandemic to ask what a company or industry will look like in 3, 6, 12 or even 48+ months from now – in fact, it should be routine.

Formulating a strategic vision in the face of uncertainty is a common challenge for leaders steering the ship toward the future – from digital disruption to geopolitical instability, proactively managed companies govern through a strategic lens capable of digging into the value-driving weeds of the business while maintaining an eye toward the big picture.

Factors that drive the business should be key forecast variables; so if the organization was impacted by uncertainty, it should be built into the forecasting model. What does the organization want to achieve? Accelerated innovation? Attracting the best talent? Becoming a market leader? Growing shareholder value? These examples of clear, measurable objectives can define the strategic vision for the organization and, in turn, how companies forecast.

Aligning strong diligence into evaluating financial and non-financial performance with a consistent, proactive and rolling forecasting approach will help:

- Create standalone and consolidated forecast models across base, upside and downside scenarios with meaningful KPI measurement.

- Stress test cash flow and balance sheet strength.

- Enable effective evaluation of business models, including tax planning and structuring techniques.

- Determine business risk profile vs. synergy opportunities (e.g. what synergies are available given the businesses current risk profile?).

By ensuring models and reports incorporate both standalone and consolidated entities – with the gap driven by synergies, and volatility coming from uncertainty mitigated by dynamic variables – companies can weigh every scenario with a planned course of action for every identified externality, and take a proactive approach to how they look at and lead their business.

Optimize the way the company operates with the right integration strategy

Now while forecasts should be built from the bottom up, strategy should be top-down. The scope, degree and pace of transaction execution focuses on similar themes regardless of the macroeconomic climate: business continuity with minimal stakeholder disruption, effective operating model/org structure and value capture. Optimizing the business to better position the organization for future growth should always be prioritized, but companies should take this opportunity to re-define what success looks like for the organization.

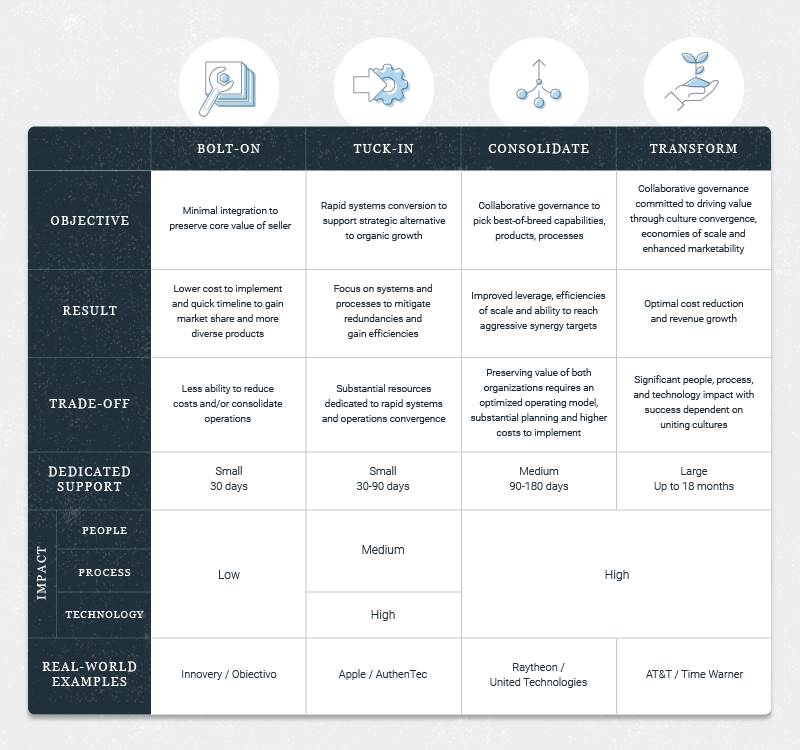

When defining an integration strategy, organizations should consider a number of important factors, including the ultimate goal of the transaction, the amount of effort needed to complete integration and any governance requirements that need to be met.

The ability to capture synergies will ultimately determine the success of a given deal, and while there is no single “right” way to integrate or carve out a business, the best approach depends on the particular circumstances of both parties involved in the deal; and requirements may even evolve as business and market conditions change. Flexibility is important as it gives organizations the opportunity to not only reassess their current operating model but, also to more effectively identify synergies necessary to make 1+1=3.

For both buyers and sellers, operating models should support the work they previously performed, the work they can currently manage and the work they would like to be able to handle in the future. The scale of integration will also be influenced by the complexity of the deal itself, as a simpler model may be appropriate to bolt-on, while deals with several moving parts may necessitate a more transformative approach.

Oftentimes, the strategies can be effectively phased, but core business drivers, transaction types and operating model decisions will set the tone for capturing deal value while considering the impact on people, process and technology with each strategy. While a tuck-in strategy focuses on integrating technology, a transformation strategy may be better suited for upskilling a workforce. A bolt-on integration strategy will likely be highly focused on speed to market with goals like geographic expansion, but what if companies have the time to deliver an effective consolidation strategy that accomplishes both?

Value capture in times of uncertainty

A strategic, comprehensive integration strategy is essential to realizing the full value of M&A deals and creating a stronger organization. Though the world will be different from this point forward, M&A will weather this storm as it has countless others in the past. From the dot-com bubble to the housing market collapse, a global pandemic could be interpreted as “on brand” with what external forces the 21st century intends to bring.

Perspective is crucial to survival, as is embracing this new understanding of globalization to realize just how interconnected we all are. Clearly, the current situation is more fraught with risk and uncertainty, but with the right strategy and support, companies can capture tremendous value from their existing deals and more effectively evaluate the deals to come.

By revamping the approach, revising deal baselines, designing deeper KPIs and improving the forecast design, companies can capture greater deal value and come out of this economic downturn more resilient. CFGI can advise companies through every step in this process, from due diligence and valuation to establishing deal governance and PMO/workstream leads. Our expert teams effectively guide organizations from the inception of a deal to final cutover and synergy capture, even getting deals back to 1+1 = 3.

To learn more, download our new white paper on finance transformation.

If you are interested in discovering more about CFGI’s Finance Transformation services related to acquisitions and divestitures, please contact Andres Garzon, Partner (agarzon@cfgi.com, 617-306-1888), Rob Winslow, Managing Director (rwinslow@cfgi.com, 617-531-8270), or Oscar Palacio, Managing Director (opalacio@cfgi.com, 617-921-3469).

Acknowledgements

Key Contributors:

Kathryn Streeter, Senior Manager, Finance Transformation – M&A SME (kstreeter@cfgi.com)

Robert Rosenwein, Consultant, Finance Transformation (rrosenwein@cfgi.com)

Oscar Palacio, Managing Director, Finance Transformation (opalacio@cfgi.com)

Matthew Estadt, Partner, TAS (mestadt@cfgi.com)