Take control of your company’s future

Business — and the nature of work as we know it — is transforming. Business leaders are under mounting pressure to deliver greater strategic value and more meaningful data and analysis — all while improving performance at a lower cost to the business.

Meanwhile, unprecedented market complexities necessitate new efficiency drivers. Failure to be agile and responsive in the face of quickly evolving conditions can manifest as cost and productivity pressures, business partner dissatisfaction, poor employee morale, fragmented business models, talent shortages and greater risk exposure.

Transformation of this nature, spanning digital, business and financial considerations, has been a very real concern for some time, but leaders need to take action now.

As the world of work continues to transform at a fundamental level, there is only one sustainable, long-term response: transform with it. Change is coming, and leaders need to adapt to thrive and put their businesses on a long-term path to success.

At CFGI, our dynamic, cross-functional experts build partnerships with businesses to develop, execute and maintain highly successful transformation strategies from visioning through design and execution. We draw on deep expertise in business and digital transformation to help you identify your north star and implement the people, process and technology changes to get there.

Our methodology

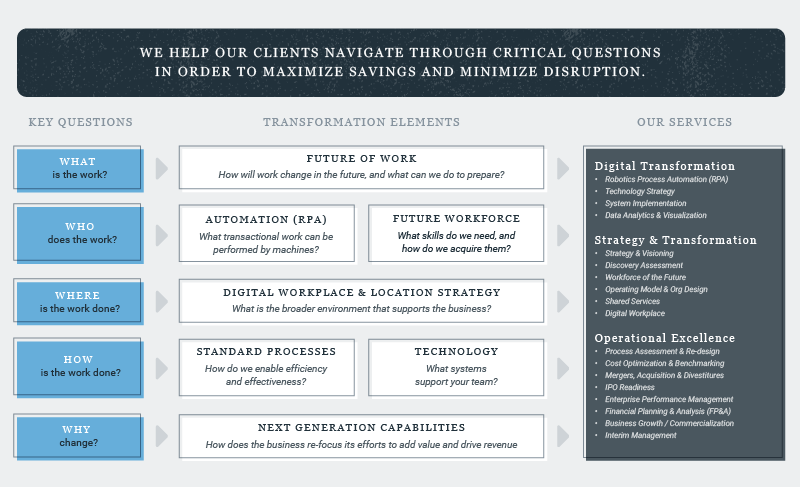

At CFGI, we address the demands and needs of business leaders by taking a methodical approach to business transformation and aligning those strategies with long-term objectives. Leaders must embrace disruptors rather than avoid or delay them. Making honest appraisals of the current state of your organization and the gulf between where you are today and where you want to be is the only way to enact real change.

We urge clients to begin every transformation initiative by answering these 5 key questions:

- What is the work?

- Who does the work?

- Where is the work done?

- How is the work done?

- Why change how work is done?

Our transformational services

We understand the ever-evolving needs of the highest levels of business leadership, and we address those demands by providing the following services:

- Discovery & Transformation – Assessing your operating model and designing and implementing the people, process, and technology changes necessary to succeed

- Automation & Analytics – Digital transformation leveraging data ecosystems, Robotic Process Automation (RPA), and advanced analytics to derive actionable insights and fuel strategic decisions

- Workforce of the Future – Preparing your workforce for the future of work, leveraging human capital strategies like organizational design, talent development, learning, remote work, and workforce analytics

- Event-Led Transformation – Navigating businesses through mergers, acquisitions, and divestitures, IPOs, and other strategic events / transactions to enhance operating performance and capture strategic value

- Technology Solutions – Helping your organization best leverage technology by aligning it with the needs of your business, drawing on vendor selection, program management, and system implementation experience

- Financial Planning & Analysis – Maximizing the value of your FP&A function and leveraging industry expertise, data fluency, and a hands-on approach to strategic business partnering

How we facilitate transformation

The imperative to transform has never been more urgent. Nevertheless, businesses must have a clear, well-supported, highly structured and data-driven approach to transformation. Otherwise, they risk walking straight into one of many potential pitfalls: unclear business strategies, limited buy-in, insufficient understanding of expectations, reactive stakeholder engagement, greater process complexity that fails to actually solve any problems, poor use of technology and, ultimately, a money pit.

At CFGI, we methodically preempt these pitfalls by delivering:

- Transparency and clarity with both bottom-up and top-down strategies.

- Change enablement at all levels of the organization.

- Hands-on support, collaboration and engagement with all stakeholders.

- Clear change management protocols with streamlined communications.

- Data-driven decision-making and quantifiable success metrics.

- Empathy, respect and thoughtfulness during change implementation.

Why CFGI?

There are as many pitfalls as opportunities in business transformation. It takes a uniquely qualified team of specialists who have extensive experience with the different facets of transformation — people, process and technology — to minimize risk and deliver optimal results.

CFGI is that team, and we are an extension of yours.

Let’s talk about how business transformation can set your organization up for lasting success.

Read our whitepaper “How Much Untapped Value Are You Sitting On?” to learn more.